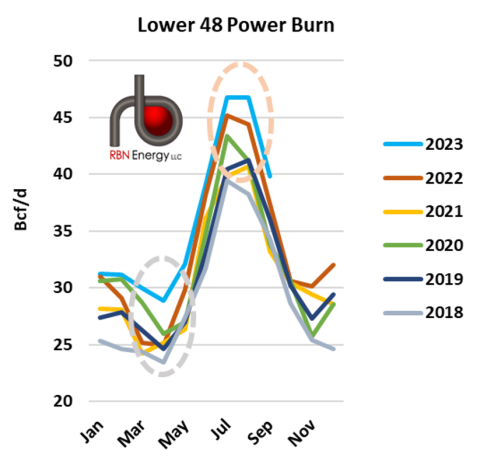

Government forecasts predict a sharp decline in demand for natural gas in the electricity sector in the coming decades, based on the expectation that the expansion of renewable capacity will accelerate and displace other sources. However, forecasts over the last decade have consistently and severely underestimated gas burning for energy. In today’s RBN blog, we consider the pitfalls of forecasting gas consumption in a world often focused on driving a renewables-intensive generation stack.

Demand for natural gas in the power sector (that is, energy combustion) was not expected to set records this summer. The summer of 2022 was exceptionally hot and energy burning hit record highs as rising coal prices kept gas cheaper even as gas prices hit record highs of 14 years. Given the bullish backdrop set by all of this, it seemed unlikely in the eyes of many that the summer of 2023 would surpass last year’s high levels of energy use, barring even hotter weather. Not only is there perpetual, if not always well-placed, optimism around the ability of renewable energy to displace natural gas, but the tight balances in the coal market had also begun to ease and coal prices were dropping sharply in early 2023. Surely there were more coal-fired power plants. due to retirement and gas plant capacity was added this year. However, renewable capacity additions were expected to steal market share and make the biggest profits.

Meanwhile, the Energy Information Administration’s (EIA) Short-Term Energy Outlook (STEO) from January predicted that gas consumption for energy will decrease by an average of 1.4 Bcf/ d year-on-year in 2023, including an average decrease of 0.5 Bcf. /d in the first semester of the year. The February STEO slightly increased the energy consumption forecast and showed a year-over-year increase over the February to April period, but continued to show substantial year-over-year declines during the hottest months. Additionally, an early February note from the EIA reiterated its expectation that natural gas generation will decline and lose market share overall as new renewable capacity is added.

Figure 1. Download 48 Power Burn. Source: EIA, RBN US NATGAS Billboard