Rapidly rising prices for goods and services have plagued the economy since the start of the pandemic, prompting the Federal Reserve to raise interest rates to help cool things down. Despite strong signs that headline inflation is easing, the negative impacts are far from over. Like all other sectors, the US exploration and production industry faced rising costs as it struggled to restore production after widespread shutdowns in the spring of 2020. However, on earnings calls in the second In the 2023 quarter, E&P executives offered guidance that suggested costs had not only leveled off, but could decline in 2024 and beyond. In today’s RBN blog, we discuss updated capital spending guidance for US oil and gas producers and their early investment outlook for 2024.

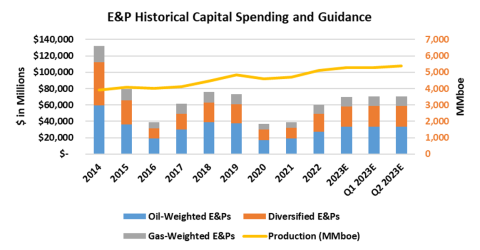

Following the pandemic-induced drop in crude oil prices in early 2020, the 42 E&P companies we monitor, all U.S. E&P companies with a market capitalization of more than $500 million dollars, they cut capital investment by 50% to just $34 billion to save cash. Despite the oil price recovery, E&P spending rose only 6% in 2021 to $39.1 billion. However, inflation of 10% to 20% in oilfield goods and services combined with the need to increase the inventory of wells drilled but not completed (DUC) after a sharp downturn in the pandemic led to a 24% increase from initial 2022 investment guidance to nearly $50 billion. As we said in our blog Take it easysustained high commodity prices allowed producers to increase drilling to offset strong shale decline rates, raising their capex guidance by 4% in both Q2 2022 and Q3 2022, and then accelerate another 12% in the fourth quarter of 2022. The result was total 2022 spending of $60.1 billion. , up 54% from the previous year and the largest year-over-year growth rate in more than a decade.

The 2023 initial capital guidance released by the companies we cover revealed a 17% increase to $70.7 billion, just 3% below the pre-pandemic (2019) investment of $72.9 billion. The increase largely reflects a combination of inflation and increased organic capital expenditures related to acquisition activity. However, our analysis of the first-half 2023 reports shows that growth has eased from the initial 2023 guidance, with the most recent capex guidance down slightly to $70.7 billion (bar multicolored at the far right in Figure 1, left axis). It is tempting to attribute some of the slowdown in investment to a recent jump in the reinvestment rate—the percentage going to capital spending—from an all-time low of 39% in 2022 to 76% in 2Q 2023 due to the decrease in cash flows from the write-off. commodity prices. But as we said in our recent Bottoms up block, higher realizations in the third quarter improve the outlook for increased profits and cash flows. Instead, E&P executives indicated in their recent earnings calls that the main factors influencing spending were increased capital efficiency and, most importantly, a strong positive trend (that is say, downward) in the costs of oilfield goods and services.

The word that dominated those conference discussions, raised most often by analysts, was “deflation.” While some E&P executives embraced the word and others danced around it, there was general agreement on a pronounced softening of the cost of oilfield goods and services. ConocoPhillips was among the most direct respondents, citing deflation in its Lower 48 assets. Management specified lower costs for tubular goods, chemicals, sand and support and discussed declining rig rates for new contracts which he partially attributed to a decline in gas-focused drilling. EOG Resources and Devon Energy also indicated they were clearly seeing deflation. Permian Resources, which recently announced the acquisition of Earthstone Energy for $4.5 billion, said it was seeing a 10% deflation in drilling costs per lateral foot and a 5% to 7% decline in costs global Diamondback Energy was more cautious, saying it was “premature” to call recent cost trends deflation, but pointed to a reduction in drilling, completion and equipment cost per lateral foot from the low $700s in early 2023 to to an estimate Low $600 later this year. Producers such as Marathon Oil, Occidental Petroleum and Vital Energy had yet to factor deflation into their future projections, but were organizing to capture cost reductions as they occurred.

Figure 1. Capital Expenditure, Production and E&P Orientation.

Source: Oil & Gas Financial Analytics, LLC