A draft environmental impact statement (DEIS) tied to a key water crossing along the Dakota Access Pipeline (DAPL) has finally been completed and released, ending another chapter in the long-running drama on the final destination of DAPL, which is by far the largest crude oil pipeline out of the Bakken. While the DEIS doesn’t end the story, the document offers clues about possible outcomes and an opportunity to revisit how important the 750 Mb/d pipeline really is to Bakken producers and shippers. In today’s RBN blog, we discuss the latest developments on DAPL and Bakken production.

More than 10 years ago, a Express Yourself (Dakota), we blogged about Koch Industries’ plan to help funnel crude oil from western North Dakota to the Gulf Coast. The plan was complicated. It called for the development of the 250 Mb/d Dakota Express, a combination of new and reused Koch pipelines from the Bakken to the Patoka, IL crude hub (via Minneapolis), and a possible connection from Patoka to the proposal of Eastern energy transfer. Gulf Crude Access Pipeline (EGCAP), which involved the reuse of the natural gas pipeline Trunkline to St. James, LA, and perhaps a new pipeline route from there to the Louisiana Offshore Oil Port (LOOP) onshore storage facility in Clovelly, LA. .

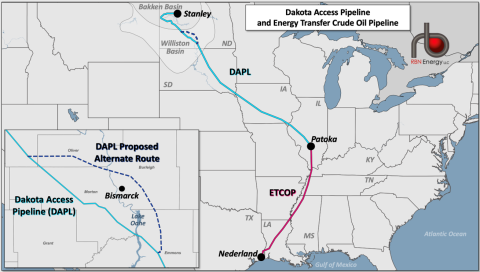

New capacity was desperately needed to take away from the Bakken: Production in the shale area (also known as the Williston Basin) grew by leaps and bounds in the first half of the 2010s, forcing many shippers to to resort to more expensive crude oil by rail. Koch’s proposed Bakken-Patoka link never came to fruition and was later replaced by DAPL (light blue line on map and inset in Figure 1), which came online in June 2017 as a facility of 470 Mb/d (see What a difference a DAPL makes). EGCAP morphed into ETCOP (Energy Transfer Crude Oil Pipeline; red line on map), which ended in Nederland, TX, (not St. James) and started the same month. DAPL and ETCOP are collectively known as the Bakken Pipeline System and are jointly owned by Energy Transfer (with a ~36% interest), Enbridge (~28%), Phillips 66 Partners (25%), MPLX (~9 %), and ExxonMobil (~2%).

Figure 1. Dakota Access pipeline and energy transfer pipeline. Source: RBN