For many years, the United States has been buying – and installing pipelines or rails – virtually all the crude oil that Canada has been exporting, in part because Canadian producers have only very limited access to coastal ports. More recently, increased pipeline access from Alberta’s oil sands to the US Gulf Coast (USGC) has created an attractive path, a “carefree highway,” if you will, for Canadian crude oil to be ” re-exported” to foreign customers. This year, much stronger international demand has driven re-export volumes to record highs, providing Alberta producers with very attractive price spreads for their oil sands crude. This overseas demand appears to be sustainable, but with the commissioning of the 590 Mb/d Trans Mountain Expansion (TMX) project, which will increase the capacity of the Trans Mountain pipeline system to 890 Mb/d, it will allow much Alberta’s rawest. to export from British Columbia docks, the USGC’s re-export increase may be on the wane, as we discuss in today’s RBN blog.

Looks like Canada’s crude oil exports are finally showing their stuff and are going out on the town. For a couple of decades, the US has been the overwhelmingly dominant buyer of Canada’s crude exports, funneling millions of barrels a day to refineries in the Midwest and, in recent years, sending more to refineries in the Gulf Coast region. In the last two years, and especially this year, this almost exclusive export relationship has finally begun to diversify from the point of view of Canadian producers, who have been finding other customers in increasing quantities in foreign markets.

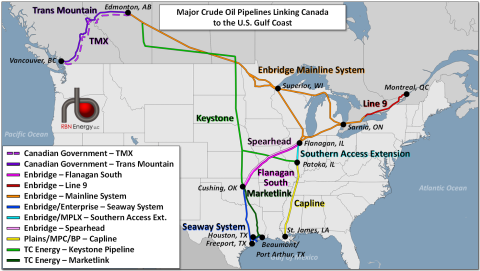

Although Canada has been exporting very small amounts of crude oil to countries other than the US since the late 1950s from the Westridge terminal outside Vancouver, BC, it began exporting more from the East Coast of Canada when offshore production began there. intensify in the 1990s, these export volumes have generally remained very modest: below 100 Mb/d. Furthermore, the expansion of these exports has generally been handcuffed by very limited export capacity at Westridge or declining production on the East Coast. With the completion and commissioning of the TMX project (dashed purple line in Figure 1) scheduled for early 2024export capacity from Canada’s west coast will increase considerably, perhaps up to 500 Mb/d.

But we are making progress. Canadian crude exports – or, more accurately, crude re-exports because they are exported from Canada to the US and then exported back from the US to other countries – have been finding their way to foreign customers in increasing amounts over the last years and they have increased this year thanks to two factors that have aligned very well. First, the expansion of previously restricted pipeline access from Canada to the US has solved, at least for now, the problem of pipeline distribution, where excess crude supply was competing for too much pipeline capacity scarce, creating lower price conditions in Canada for its pipeline. flagship heavy crude, while limiting the amount of crude reaching the Midwest and Gulf Coast. With the completion of Enbridge Mainline Line 3 Replacement Project in 2021 (orange lines in Figure 1) and additional access via Enbridge’s Spearhead, Flanagan South, and Seaway pipelines (light pink, dark pink, and blue lines, respectively), combined with TC Energy’s Keystone Pipeline (line light green) and Marketlink Pipeline. (dark green line), as well as the Capline pipeline investment (yellow line) from Patoka, IL to St. James, LA, Canadian crude now has open pipeline access from the Alberta oil sands in northeastern Alberta to export docks along the USGC. Simply put, pipeline capacity constraints appear to be a thing of the past as they allow still-growing production of oil sands crude to reach customers on the Gulf Coast and now the rest of the world.

Figure 1. Major crude oil pipelines linking Canada to the US Gulf Coast. Source RBN