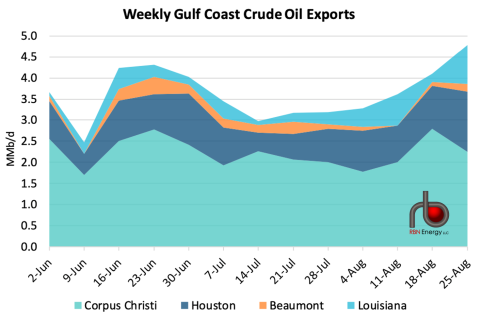

The level of activity at crude export terminals from Corpus Christi to the Louisiana Offshore Oil Port (LOOP) is nothing short of extraordinary: a record 4.8 Mb/d was loaded in the week ending 25 of August, according to the Crude Voyager report from RBN and Houston. – area terminals loaded an all-time high of 1.4 Mb/d. But there is much more to the story of crude oil exports. When you experience these things day in and day out, you see subtle changes that often extend to trends, and if you’re lucky, sometimes you get signs that things you predicted are actually happening. On today’s RBN blog, we discuss highlights from the latest Crude Voyager and what the data and analysis from the weekly global oil market report reveals.

As the name suggests, the shale revolution has changed everything. Perfecting this miraculous combination of horizontal drilling and hydraulic fracturing not only changed the US energy industry, but also made the US a leading exporter of crude oil. i natural gas i NGL. The crude oil part of the story is particularly inspiring. Consider this fact: At the end of August, crude oil production in the Lower 48 averaged about 12.4 Mb/d an estimated 4.6 Mb/d (or 37%) of crude d ‘US origin, plus another 150 to 200 Mb/d of Canadian crude that is usually “re-exported” through Gulf Coast terminals: it was loaded onto the Very Large Crude Carrier (VLCC), Suezmax, Aframax and other tankers to ship overseas.

On a day-to-day basis, and largely behind the scenes, we track dozens of large vessels as they enter the Gulf of Mexico, arrive at the docks, and are loaded with crude oil (mostly light and sweet) that is then shipped directly to international near and far terminals or light on VLCC for cheaper and long distance shipping to Europe and the Asia-Pacific region. As we said in today’s blog introduction, the week ending August 25th was a record, not just in terms of the 4.8Mb/d that were uploaded (stacked layers on the far right in Figure 1), but also in terms of the record 41 tankers loaded. and the record 1.4 Mb/d loaded at terminals in the Houston area (dark blue layer in the chart). [Note that statistics reported by the EIA in its Weekly Petroleum Status Report have peaked higher than that — to 5.6 MMb/d in February this year. But while our statistics generally line up with the EIA over time, our observed exports are considerably less “peaky” than the EIA’s.]

Houston’s big number (93 Mb/d above the previous high) may be a bit of an anomaly, but it was interesting nonetheless. We have been saying for many months (see February Houston Bound) that although the Corpus Christi area will still dominate crude oil exports, mainly due to the capacities of the Enbridge Ingleside Energy Center (EIEC) and Gibson Energy’s Gateway to South Texas (STG) – Houston area terminals were poised to take on an increasing share of total export volume. In fact, so far this year, 25% of barrels leaving the Gulf Coast have been loaded at Enterprise Houston, Energy Transfer Houston, Seabrook Logistics and other terminals in or near Houston, compared to 59 % of Corpus Christi, in the first 25 days of August, Houston’s share increased to 27% while Corpus’ share fell to 55%. For the full year 2022, terminals in the Corpus area accounted for 61% of crude export volumes and Houston for only 22%.

Figure 1. Weekly crude oil exports from the Gulf Coast by terminal area. Source: Crude Voyager