In the past 12 months, U.S. natural gas prices have hit highs not seen since the start of the shale revolution, as well as depths from which they briefly dipped during downturns in 2012, 2016 and 2020. Where will prices go next? Well, if we knew, we wouldn’t be blogging. As we’ve seen in the last couple of years, there’s too much going on in global markets to think you can know where gas prices will be 10 years from now, five years from now, or even a year from now. But that never stopped us from trying. As we have done many times before, we will take a scenario approach: a high case and a low case. In today’s RBN blog, we’ll explore these scenarios for domestic natural gas prices and what kind of ramifications each would imply for other markets.

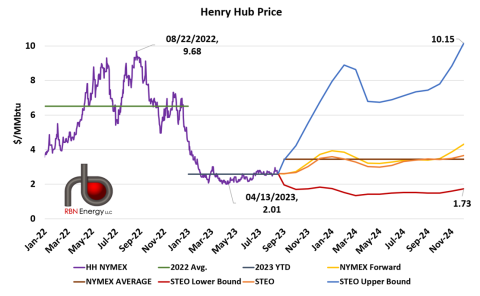

Just over a year ago, on August 22, 2022, the Henry Hub flash price settled at $9.68/MMBtu – the zenith of a five-month run in which the point of benchmark was regularly set in the range of 7-9 dollars/MMBtu. Henry average just above $6.50 in 2022 (dark green horizontal line at left in Figure 1), significantly higher than the one-day settlement since 2008, when shale drilling began that domestic gas was plentiful and cheap. (The high point between those two times was February 19, 2014, when Henry settled at $6.15/MMBtu.) While gas sellers in the US likely have fond memories of that time, gas buyers, especially those across the pond, were having a very different experience.

However, the price hike did not survive until 2023 and so far this year, Henry Hub has averaged just $2.58/MMBtu (dark blue horizontal line in the lower middle), a price lower than the balance of almost all of them focused on natural gas. play The nadir was on April 13 when NYMEX settled at $2.01/MMBtu. Prices have since risen to around $2.50 – $2.60/MMBtu bar, with many days higher than this, due to stronger demand for LNG feedgas and a sweltering summer that has caused an increase in energy demand. The price has fallen somewhat recently as temperature forecasts begin to moderate, LNG feedstock has slowed and production remains robust.

The forward curve (yellow line) falls comfortably between last year’s extremes and averages $3.45/MMBtu through 2024 (brown horizontal line on the right). One more data point: The Energy Information Administration’s (EIA) Short-Term Energy Outlook (STEO; orange line) is pretty close. But if you’ve ever been to one of our previous energy schools, you’ve surely heard us say, “Future prices are no indication of future prices.”

Figure 1. Historical and forward price of Henry Hub. Sources: CME/NYMEX, EIA STEO