Given all the recent attention, you might think that the prospects for carbon capture project development are fantastic. In the US, last year’s Inflation Reduction Act (IRA) included significant increases to the 45Q tax credit for carbon capture, improving the economics of a wide range of carbon capture projects. Globally, it seems clear that efforts to reduce greenhouse gas (GHG) emissions and reach a net zero world will continue for a long time. Almost all plans to achieve this target include a significant reliance on carbon capture, with the International Energy Agency (IEA) predicting that 7.6 billion metric tons per year (MMtpa) of carbon dioxide (CO).2)—that is, 7.6 gigatons per year—will need to be captured and sequestered by 2050. We are a long way from these levels, given that most estimates place global carbon sequestration capacity at slightly more of 40 MMtpa today, or less than 1. % of what the EIA thinks we will need in less than 27 years. In today’s RBN blog, we look at the main factors holding back the broader commercialization of carbon capture initiatives in the US

First, let’s start with a look at the bright side. The pace of development of the carbon capture industry has increased significantly in the past two years, with 244 MMtpa of capacity under development and 61 facilities added to the global project portfolio by 2022, according to the latest annual report by the Global CCS Institute. But, as has happened elsewhere, the number of CCS projects progressing from concept to financing, construction and commercial operation has been limited. According to the institute’s facilities database, there are only 14 carbon capture projects in commercial operation worldwide. (To be considered a commercial facility, the CO2 must be captured and transported for permanent storage as part of an ongoing commercial operation. Among other things, pilot and demonstration facilities may or may not permanently sequester captured CO2 and are not intended to support a commercial return during operation.)

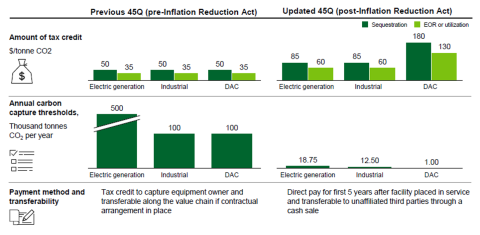

So if there are new incentives and the global environment for carbon capture has never been better, why isn’t the industry taking off at a faster rate? As we mentioned in our Way down into the hole series, the highly variable costs Carbon capture remains an issue with multiple impacts on the industry as a whole. In general terms, installations that emit CO2 it can be grouped into two buckets: high purity and low purity. For the most part, high-purity sources include processes with very concentrated CO2 current, usually where CO2 it is a by-product and is much easier (and cheaper) to separate and capture, such as with ethanol production or natural gas processing. Low purity sources are generally from a process where the CO2 it is a product of combustion and mixes with other emissions, making it harder (and more expensive) to capture, such as a coal-fired power plant. Figure 1 below shows the level of tax credits for carbon capture and sequestration (CCS, dark green bars) and carbon capture use and sequestration (CCUS, light green bars), both before the IRA (left side of the graph) and after (right side). of graph).

Key changes to the 45Q tax credit under the Inflation Reduction Act

Figure 1. Key changes to the 45Q tax credit according to the Inflation Reduction Act.

Source: Department of Energy