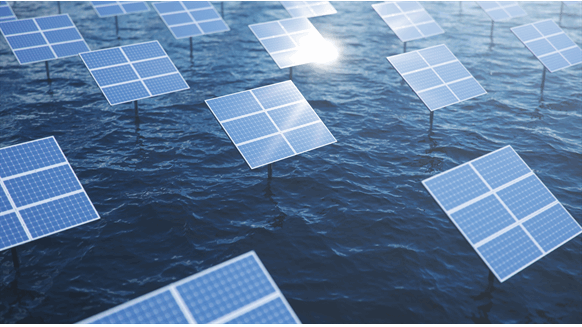

Battered by waves of up to 10 meters (32 feet) in China’s Yellow Sea, about 30 kilometers off the coast of Shandong province, two circular rafts carrying rows of solar panels began generating electricity in late last year, a crucial step toward a new breakthrough for clean energy.

The experiment by State Power Investment Corp., China’s largest renewable energy developer, and Norway-based developer Ocean Sun AS is one of the most high-profile tests of offshore solar technology to date. This is a potential industry breakthrough that would enable offshore locations to host renewable energy and help land-constrained regions accelerate the transition from fossil fuels.

Most of the initial trials of solar energy at sea have involved small-scale systems, and there are still numerous challenges to overcome, including higher costs and the impacts of corrosive salts or destructive winds. However, developers are increasingly confident that offshore solar power can become an important new segment of renewable energy.

“The application of this is virtually limitless,” because many regions have land-use constraints, including parts of Europe, Africa and Asia, along with locations such as Singapore and Hong Kong, the adviser said Ocean Sun delegate, Borge Bjorneklett. “In these places, you see a lot of interest in this technology.”

Shandong, the industrial hub south of Beijing, plans to add more than 11 gigawatts of offshore solar by 2025 and eventually build 42 gigawatts, more than Norway’s current power generation capacity. Neighboring Jiangsu is aiming to add 12.7 gigawatts, while provinces such as Fujian and Tianjin are also considering proposals. Japan, the Netherlands and Malaysia are among other nations conducting or preparing pilot projects.

Even with investments in solar forecast to exceed spending on oil production for the first time this year, many regions face challenges in finding land to install a wide variety of panels, either because of a lack of available space, as a result of inhospitable terrain or because to do so would require deforestation.

This is fueling a push to examine new, and sometimes unlikely, sites for solar power that have already seen hundreds of floating projects delivered to lakes, reservoirs, fish farms and dams. Japan has dozens of smaller factories, China and India have added large operations, and facilities have been built in countries such as Colombia, Israel and Ghana. In January, the largest floating solar project in the United States came fully online, providing enough power for 1,400 homes from panels at the Canoe Brook Water Treatment Plant in New Jersey.

“Renewable energy installation needs to grow, but the realistic question is where to build it,” said Li Xiang, head of Hefei-based water solar power unit Sungrow Power Supply Co. based in China, one of the largest renewable energy equipment manufacturers in the world. . “We think water surfaces have great potential.”

Stretched across the dark green water of a man-made lake in Huainan, in eastern China’s Anhui province, is an installation of about half a million floating solar panels clustered in large blocks, with white geese swimming. The project, built by Sungrow, on the site of a former coal mine that has since filled with water, covers the size of more than 400 football fields and generates power for more than 100,000 homes.

water-filled coal mine in Huainan, China. Photographer: Qilai Shen/BloombergThe facility covers the size of more than 400 football fields and generates power for more than 100,000 homes. Photographer: Qilai Shen/Bloomberg

Adding solar systems to existing reservoirs could theoretically allow more than 6,000 global cities and communities to develop self-sufficient energy systems, said researchers such as Zeng Zhenzhong, an associate professor at Shenzhen Southern University of Science and Technology, in an article published in March. “We don’t have to fight for farmland, and we don’t have to cut down forests or even go to deserts,” Zeng said in an interview.

However, further assessments of the potential long-term consequences of covering bodies of water with panels are needed, the researchers found. China’s authorities have also become cautious. New developments at some freshwater sites were banned last May amid concerns about impacts on ecosystems and flood control. A solar installation in Jiangsu province that covered 70 percent of the surface of a lake was partially dismantled after local officials raised objections.

Although solar plants on freshwater sites are expected to continue to expand globally, some of these concerns, and the potential of offshore projects, are helping to drive activity in the offshore sector. China’s Ministry of Science and Technology has made it a key priority to develop near-shore floating technologies by 2025, while companies such as Sungrow are among those collaborating with researchers.

Ocean-based solar arrays that can handle waves of up to four meters could be ready for commercial deployment within a year, and systems capable of withstanding 10-meter-high waves will take at least three years to perfect , according to Ocean Sun. Viable technology could be ready within a year or two, according to Southern University’s Zeng, who is also studying offshore developments.

Developers are experimenting with different concepts. Ocean Sun’s ring-shaped floats, made of high-density plastic tubes and a membrane with panels distributed over the surface, undulate with the movement of the waves. SolarDuck AS, based in Rotterdam, mounts panels on triangular platforms and has agreements to test its systems, including in Tokyo Bay and at a project off the coast of Tioman Island in Malaysia.

Questions remain about the ultimate scale of the offshore solar market. Developing offshore panels could be about 40 percent more expensive thanks to more complex installations and costly undersea cables, according to BloombergNEF estimates. Unlike offshore wind, which produces more power than onshore farms due to stronger gusts and larger turbines, there is no significant benefit to power generation in harvesting the sun’s rays at sea compared to earth.

“Offshore solar in some ways is the worst of both worlds,” said Cosimo Ries, an analyst at Trivium China. “You get the higher installation costs, but you don’t get the higher power output.” Offshore solar is likely to end up being a niche sector, serving mostly landlocked coastal cities like Singapore, Ries said.

Proponents insist the technology is improving rapidly and will gain a role in helping nations with large populations and land shortages curb emissions and, for many developing economies, meet still-growing energy demand.

Longi Green Energy Technology Co., the world’s largest panel producer, is developing modules especially suited to sea conditions and has a study underway in Jiangsu province. While it now sees the size of the market as limited, there is “relatively large potential for offshore solar,” the company said in a March conference presentation in Xiamen.

China alone has the potential to host about 700 gigawatts of offshore solar, about the same electricity generation capacity as India and Japan combined, according to a state energy investment forecast.

“It won’t be difficult,” said Zeng of Southern University. “People haven’t realized the potential it has yet.”