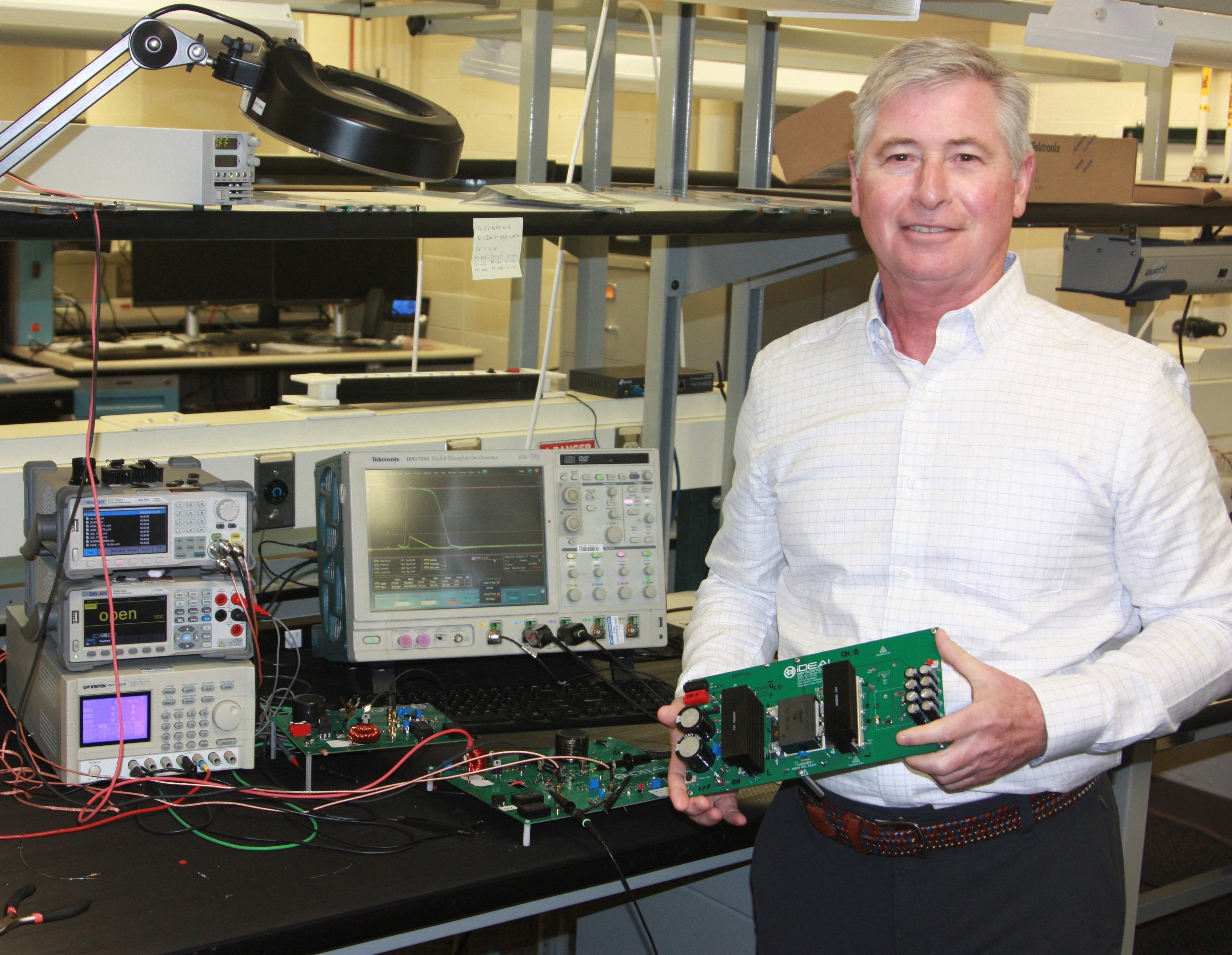

[1/2] Mark Granahan, chief executive of iDEAL Semiconductor, is pictured with the company’s energy-efficient power chips, in this undated file photo received on May 15, 2023. Courtesy of iDEAL…

May 16 (Reuters) – iDEAL Semiconductor said on Tuesday it has raised a new round of funding and is launching new technology that can make chips for electric vehicles and data centers more efficient while using cheap and easy materials available

iDEAL’s technology is a new way of making what are called power chips, which are included in everything from washing machines to internet servers to help with tasks such as converting alternating current from the electricity grid to the direct current used by the device.

A new wave of power chips from companies such as Wolfspeed Inc ( WOLF.N ) and On Semiconductor Corp ( ON.O ) made from a material called silicon carbide may help expand the range of electric vehicles because the chips are more efficient .

But the materials are expensive and still face supply bottlenecks compared to the cheaper standard silicon used in most chips. iDEAL says it has developed a new recipe that borrows from fields like solar panel technology to make standard silicon chips that can compete with more exotic materials in energy efficiency.

“We’ve had this drumbeat for the last 10 years that silicon is dead,” said Mark Granahan, CEO of iDEAL. “Honestly, it’s the lack of innovation in silicon that has allowed the drum beat.”

The Lehigh Valley, Pennsylvania-based company said it has raised $40 million, bringing its total raised to date to $75 million. The company’s backers include the investment arm of semiconductor manufacturing equipment maker Applied Materials ( AMAT.O ).

iDEAL has partnered with Bloomington, Minn.-based chipmaker Polar Semiconductor to manufacture its first chips and plans to launch them later this year.

Granahan said silicon carbide chips may still outperform iDEAL’s for certain applications, including extremely high-voltage chips needed for applications such as semi-electric trucks. But he said iDEAL’s chips could be competitive for about 90% of the global power chip market.

“We’re in the early days with the technology, and we’re certainly going to push the limits,” Granahan said.

(This story has been corrected to correct details of funding rounds in paragraph 6)

Reporting by Stephen Nellis and Jane Lanhee Lee in San Francisco; Lincoln Feast Edition

Our standards: the Thomson Reuters Trust Principles.