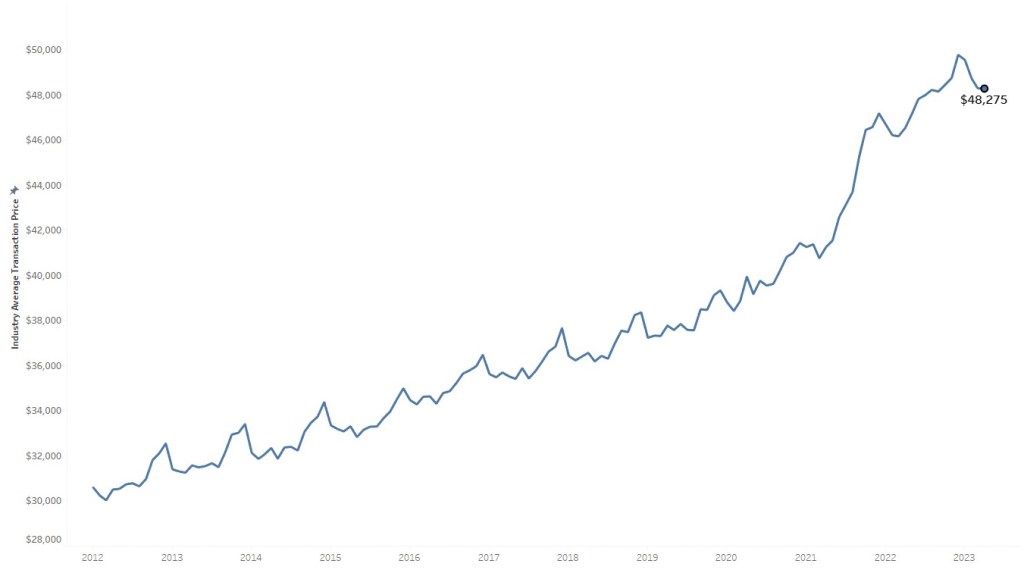

ATLANTA, May 9, 2023 – The average price Americans paid for a new vehicle in April remained below the manufacturer’s suggested retail price (MSRP) for the second month in a row, according to data released today by Kelley Blue Book, a Cox Automotive company. The average transaction price (ATP) of a new vehicle in the US was relatively flat in April 2023 at $48,275, a month-on-month decrease of 0.03% ($14) from a revised reading in March rise of $48,289.

AVERAGE NEW VEHICLE TRANSACTION PRICE

New vehicle transaction prices in April rose 3.7% ($1,744) compared to year-ago levels. Meanwhile, incentive spending by automakers rose to the highest level in a year at 3.6% of ATP in April, averaging $1,714.

After 20 months of new vehicle ATP maintaining an above-average MSRP or sticker price, transaction prices are trending downward. In April 2023, the average price consumers paid fell to $378 below sticker price. By comparison, a year ago, the average ATP was $600 above MSRP. Sales volumes were down 1.5% month-on-month but rose 9.0% year-over-year in April, more than most forecasts and fueled by higher inventory levels and a healthy dose of fleet deliveries.

“New vehicle transaction prices are trending downward in 2023, which should feel like a breath of fresh air for buyers after the past few years of low supply and rapidly rising prices,” said Rebecca Rydzewski , director of research for Cox’s Economic and Industry Insights. automotive “Now that inventory levels are starting to rise and manufacturers are increasing incentives, the market will respond accordingly. High interest rates on auto loans remain a major issue for many buyers, but trends in inventory and pricing are positive in the market right now.”

Average prices for non-luxury vehicles rise in April

The average price paid for a new non-luxury vehicle in April was $44,750, up $461 from March 2023. Year-over-year, non-luxury prices rose 5.2%. While the average non-luxury sticker price topped $45,000 in April, buyers still paid $381 below MSRP.

Several non-luxury brands, including Chrysler, Ford, Honda, Nissan, Toyota and Volkswagen, saw ATP declines between 0.2% and 3.5% monthly in April. Kia and Honda showed the most price strength in the non-luxury market, trading between 3% and 4% off the sticker price in April, respectively. Both companies continue to have inventory levels well below the industry average.

Average luxury vehicle prices fall in April to well below $65,000

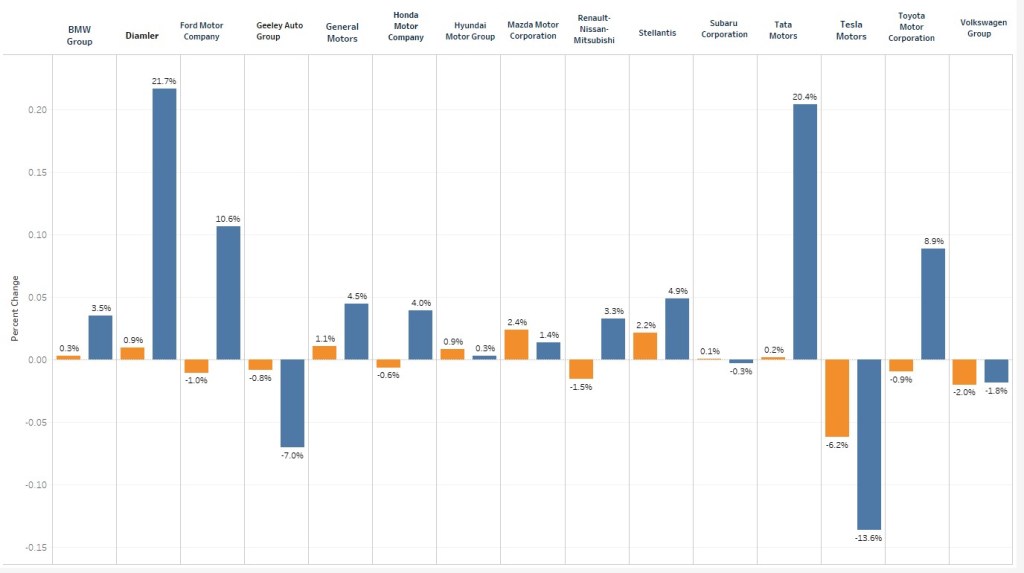

The average luxury buyer paid $64,144 for a new vehicle in April 2023, down $1,605 from March, and first-time luxury transaction prices fell below $65,000 in 11 months. Transaction price estimates for Tesla, the leading luxury brand in the US, continue to show the results of price cuts across all four of the company’s vehicles.

In key segments, luxury vehicle ATPs were mixed in April, with entry-level luxury cars, high-end luxury cars, luxury compact SUVs, mid-size luxury SUVs and luxury subcompact SUVs that showed price drops between 0.5% and 1.4%. Luxury cars and luxury full-size SUVs saw price increases between 0.8% and 1.6%.

Strong sales of luxury vehicles have been a major reason for the high global price of new vehicles. This trend continued in April, with the share of luxury vehicles at 18.2% of total sales. However, the luxury share is trending downward after reaching a high of 19.5% in February.

PERCENTAGE OF PRICE CHANGE BY AUTOMATIC MANUFACTURER

New electric vehicle prices in April were down more than $10,000 from a year ago

Initial estimates for the average price paid for a new electric vehicle (EV) in April declined from March by $4,464 (down 7.5%) to $55,089. The ATP for electric vehicles in April 2023 is down $10,096 compared to a year ago. The average new electric vehicle sold for an upwardly revised $59,553 in March, according to Kelley Blue Book estimates, which is still well above the industry average. The price of new electric vehicles peaked in June 2022 and has dropped significantly so far in 2023.

“The downward movement in average transaction prices for electric vehicles in April reflects electric automakers, particularly Ford and Tesla, seeking a balance between pricing and profitability,” said Michelle Krebs, executive analyst at Cox Automotive. “With average EV prices trending lower, we’re seeing EV sales increase. For example, EV sales estimates in April were up 26% year-over-year.”

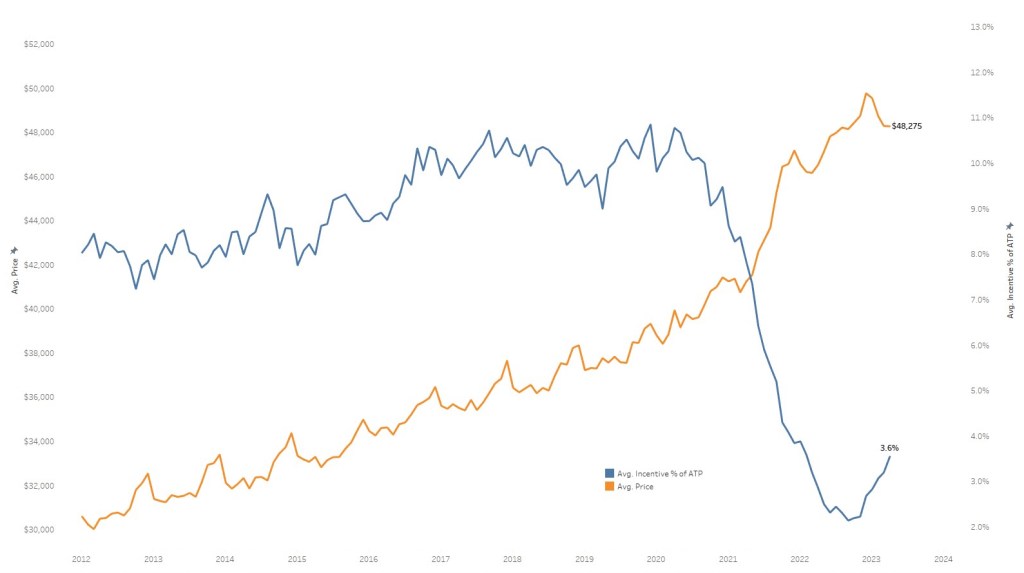

Auto incentives offered by manufacturers continue to trend upward as supply increases

Incentives averaged $1,714 in April to hit a one-year high, rising to 3.6% of the average transaction price compared to 3.2% in March. Although April incentives were up $170 month over month, they remain at a historically low level. By comparison, Kelley Blue Book estimates that incentives averaged 7.8% of ATP in April 2021 and 9.0% in April 2019. The luxury car segment had the incentives highest in April 2023, with 7.7% of ATP. Meanwhile, vans had the lowest incentives at just 0.3% of ATP.

AVERAGE INDUSTRY TRANSACTION PRICE VERSUS AVERAGE INDUSTRY INCENTIVE SPEND AS % OF ATP

“Incentives are one way automakers can ensure new vehicle inventory levels are kept under control,” Rydzewski said. “Buyers can benefit significantly from incentives that manufacturers are increasing, including special low APR financing to help keep new auto loan rates attractive. As supply continues to increase, incentives are likely to means of the industry also go up”.