Piotrekswat/iStock via Getty Images

This is what dividend investing is all about! Investing in dividend stocks allows you for dividend income, the best passive income stream! Bias, you better believe it.

Time to dive into Lanny’s April 2023 dividend income results! Were records set? Almost to financial freedom? One day and one month at a time!

Dividend income

Dividend income is the hard work of investing your money in the stock market. Also, dividend income is my primary vehicle on the road to financial freedom, which you can see through my Dividend portfolio.

How can I research and search for dividend stocks before making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom products) as well as SoFi’s (SOFI) investment app, commission-free.

me it also automatically invests and maxes out, pre-tax, my 401(k) through work and my health savings account. This saves me one ton of tax money (aka thousands), which allows me to invest even more. Also, any dividends I receive are automatically reinvested back into the company that paid the dividend, also known as a Dividend Reinvestment Plan or DRIP for short. This takes the excitement out of timing the market and build to my passive income stream!

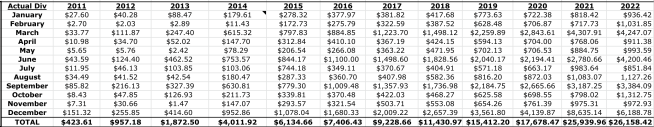

Growing your dividend income takes time and consistency. Investing as often and early as possible allows compound interest (aka dividends) to work its magic. I’ve gone from making $2.70 in a single month in dividend income to over…$10,000 or more in a single month. A new The dividend income record was set in December 2021. Unfortunately, it didn’t break it in December 2022. However… was it broken this month? The power of compounding and dividend reinvestment is a wonderful portfolio component. Every month, big or small, I continue to report the passive income that dividend investing provides me. Because?

*My wife’s dividend income is not pictured above*

I want to show you that investing dividends allows you to achieve financial freedom and/or financial independence. We all start somewhere, but investing consistently, accumulating (reinvesting) dividends and keeping it simple puts you in a significantly better position than most. Also, if I can grow this portfolio and this income stream, you can also

Dividend income – April 2023

Now for the numbers… In April, we (my wife and I) received a total dividend income of $1,596.82. We’ve crossed $1000 again and I don’t see us taking any steps back, only forwards.

Always keep this in mind, the amount and number of stocks below show you what it means to buy and hold for the long term. Most of the positions I’ve held years, let dividend growth and reinvestment do their thing. This is what dividend investing for financial freedom is all about. Passive income stream is growing a fast Rhythm. More than a decade of investment is a snowball in itself, but we keep investing as much as we can.

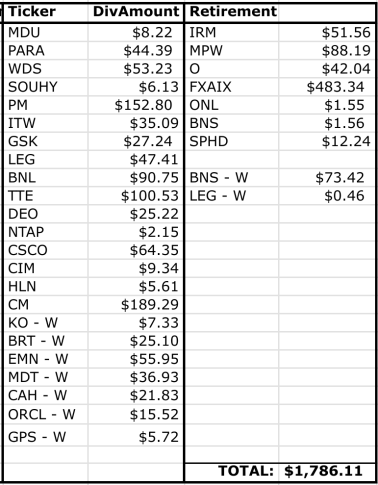

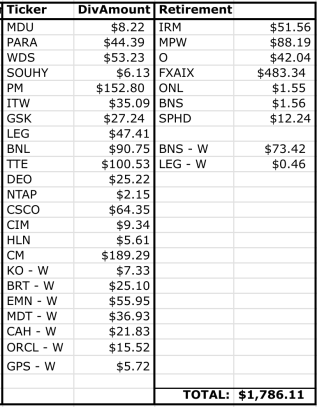

Here’s the breakdown of dividend income for the month of April, between taxable and retirement accounts (far right column, under “Retirement”). Also, “W” stands for my wife’s account:

So what happened to dividend income this month?

Philip Morris (PM) basically says quit smoking, send Lanny $150 in dividends. I absolutely love it.

My new REIT, Broadstone Net Lease (BNL) is also close to $100. This was the REIT I invested in, after the sale of STORE Capital.

Total Energies (TTE) also produced over $100 in dividends for me this quarter. Big oil is setting massive records, left and right.

As for retirement income, my 401(k) mutual fund investment is Fidelity’s S&P 500 (FXAIX) and that dividend was huge at $483. Payment is quarterly, but usually comes one month after the end of the quarter.

I’ve also split my retirement accounts into the far right column and the taxable account dividends are in the left two columns. Retirement accounts consist of HSA, ROTH, and traditional IRA investments, as well as our work 401(k) accounts. In total, the retirement accounts accounted for a total amount of dividend income of $754.36 or 42% of the total dividend income. We were still successful in earning over $1,000 in taxable dividends during April, Here we go!

Year-on-year comparison of dividend income

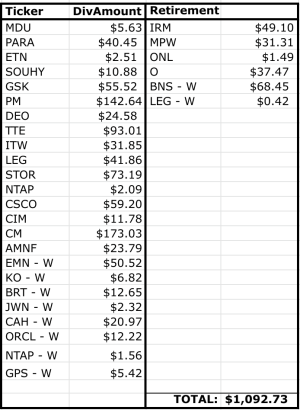

2022:

2023:

Fortunately, our dividend income increased by $693.38 or 42%. shredding growth, which we will really see why in the following paragraphs below. Almost doubling last year’s income is a very fun show! What has happened to dividend income year over year?

First, Fidelity’s S&P 500 mutual fund paid me in April. Boom, that’s a $483 impact right there, most of the increase.

Second, BNL, the REIT, is much higher than STORE Capital, because the yield is a little higher, and I bought more of it. This dividend check was $17 higher.

Third, Canadian Imperial (CM) is a combination of 3 things. Dividend growth, dividend reinvestment and buying a few more shares here and there. That was $16 more.

Ultimately, all the dividend increases and reinvestment fueled most of the rest. We’re talking about Philip Morris, Cisco (CSCO), and Realty Income (O), just to name a few.

Overall, an amazing dividend month. The April 2024 goal would be sweet to have $2,500. Here we go! Keep investing.

Increase in dividends

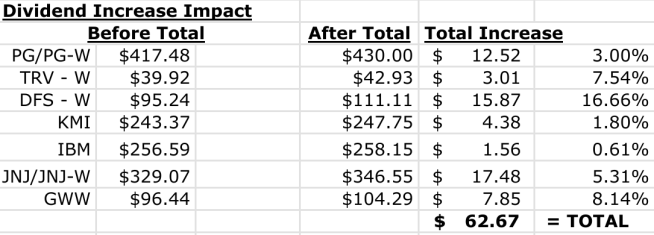

Dividend increases kept the train rolling from March to April, with 7 dividend increases shown below!

The biggest surprise came from Discover Financial (DFS). A dividend increase of 16.66% was not anticipated, and this only added almost $16 to our forward dividend income!

We also had two dividends kings increase its dividend as usual in April. Both Johnson & Johnson ( JNJ ) and Procter & Gamble ( PG ) raised their dividend at lower-than-normal rates. High inflation may be affecting its margins, with the JNJ spin-off also; not to mention the settlement of the talc lawsuits.

In total, the dividend increases created additional passive dividend income of $62.67. You would need to invest $1,790 with a 3.50% dividend yield to add to that income. Thanks for the raises as I didn’t have to come up with the capital to create this form of income!

Conclusion and summary of dividend income

Applying what you learn through financial education is the name of the game. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. My plan is to show that dividend income can be an income driver; a revenue engine that allows you take back control of your life, an income engine to help you achieve financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to make a lot of sense!

Excited about the future, no doubt. In addition, all the investments of the past year and the movements of this year show that my goal save 60% of my incomei make every dollar counthas provided dividend growth.

As always, thanks for stopping by. Leave your comments and questions below. Good luck and happy investing everyone!

Original publication

Editor’s note: The summary picks in this article were chosen by the editors of Seeking Alpha.