Europe’s oil refiners, already without long-standing shipments of Russian crude, are now struggling with the loss of similar supplies from northern Iraq and a cut in output by several major producing countries Of the world.

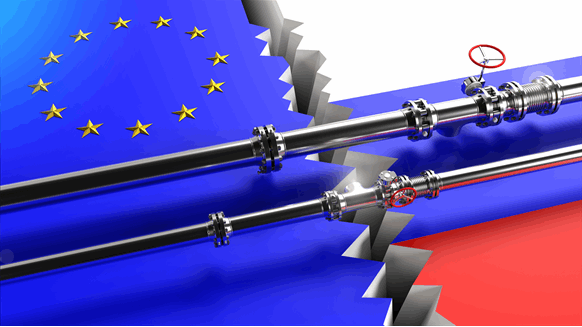

Flows from Russia, once the main supplier to the European Union, have fallen by more than a million barrels a day since the country’s invasion of Ukraine in February last year, amid increasingly tougher sanctions.

These reductions are now beginning to bite harder because Iraq has halted shipments reaching Europe through a Turkish port on the Mediterranean Sea. Also, OPEC+ producers, including Russia, have announced supply curbs starting next month that will cut output by about 1.6 million barrels per day in July.

For Europe, the loss comes at an unfortunate time. Russian and Iraqi grades have similar sulfur density and quality, and refiners in Asia, especially China, are increasing demand for this so-called medium acid oil that forms their staple diet.

“A tough battle is expected between Europe and Asia, and Asia could outpace European supply per barrel, which could lead to European cuts to balance the crude market,” Energy Aspects Ltd. analysts said. Amrita Sen and Christopher Haines in a recent note on global oil markets. including medium-acid crude.

In March, the EU imported 95,000 barrels a day of Russian Urals, compared with nearly 1.2 million barrels a day in February last year, data compiled by Bloomberg showed. All the cargoes were sent to Bulgaria, which has exemptions from EU sanctions on seaborne crude imports from Russia.

Europe has replaced at least a quarter of Russian supplies with Middle Eastern crude since spring 2022, according to Energy Aspects. Flows from the Atlantic basin, from Norway and Angola to the US, also rose in the first three months of this year, the International Energy Agency said in its monthly report earlier this year. this month.

But now there is another wrinkle in the Middle East. Since last month, some 450,000 barrels per day of crude supplies from Iraq’s Kurdish region have been halted amid a payment dispute. In March, at least 169,000 barrels per day of this oil, shipped through the Turkish port of Ceyhan, went to EU countries, tanker tracking data shows.

The restrictions add to the tightening of the medium sour crude market as Middle Eastern producers are also using more of their own oil to fuel processing at new domestic refineries.

In the Mediterranean, prices for grades such as Iraq’s Basrah Medium, which are often heavily discounted compared to others because of their sulfur levels, have risen to a level many traders see as too expensive.

Greek refiner Hellenic Petroleum SA also made a rare bid, its first in two years, to buy fast supply of Basrah Medium. Some traders said the move indicated the tight availability of such barrels in the spot market amid the loss of Kurdish ratings.

–With the assistance of Anthony Di Paola.