Shareholders hate it. It’s bitter medicine for the industry that drove the high and drove up prices so average Americans can no longer afford new vehicles.

By Wolf Richter for WOLF STREET.

What Tesla has been doing is fascinating, and it’s wreaking havoc among legacy automakers. Tesla shareholders hate it, and the stock has sold off, even though it’s still ridiculously overpriced. And shares of other automakers also sold off.

Tesla deliveries continue to increase. In the first quarter, global deliveries were up 36% year-on-year, which is a huge increase. Its global market share has exploded. In the US, its market share reached close to 4%, tripling from 2020. This blew away other carmakers. In the first quarter, it delivered a record 422,875 vehicles worldwide.

But it has increased production and production capacity even faster. First quarter production increased by 44% to 440,808 vehicles. It has ramped up production and invested in production capacity so relentlessly that for two consecutive quarters it produced far more vehicles than it sold.

During those two quarters combined, it built 880,509 vehicles and delivered 828,153 vehicles. In other words, sales have soared, but production and production capacity have outpaced sales growth.

And now it has to sell those 50,000 or so vehicles that it hasn’t sold, plus the vehicles that it’s launching in the second quarter, and instead of cutting production, it’s cutting prices to increase sales.

And it can afford to because it had the biggest profit margins of any major automaker to begin with. For legacy automakers, with their relentless price hikes for internal combustion vehicles and declining sales, Tesla’s price cuts and the threat of overcapacity are a big threat.

Tesla continues to build capacity with new factories. Now it has a bunch of vehicle assembly plants, auto component factories, battery factories, manufacturing equipment factories where it builds some of its own manufacturing equipment, etc. in the USA, Europe and China. It is building an assembly plant in Mexico. There are rumors that a deal is nearing to build an assembly plant and component plants in Indonesia.

Unlike other automakers, such as General Motors and Ford, it doesn’t burn cash by buying back its own stock, doesn’t pay dividends, and doesn’t have to take on debt to finance that capacity or its product. development; it funds them with its operating cash flow. And it had $22 billion in cash in the first quarter, up from $18 billion a year ago.

Overcapacity and price cuts. Those two words are the bane of legacy automakers. Those are horror words for legacy automakers.

What Tesla is doing is the best medicine for the auto industry ever, and it’s bitter medicine for Tesla, GM, Ford shareholders et al., and they hate it because now they’re sitting on these over-the-top things that went down in price. But what?

What matters is saving the industry through new competition that pushes it to produce cars that the average American can once again afford.

The industry has spent the last 20 years raising and raising prices to the point where the average American can no longer afford a new vehicle. American brands have killed off their entry-level ICE cars over the past few years because they had small price tags and lower profit margins than the big rigs.

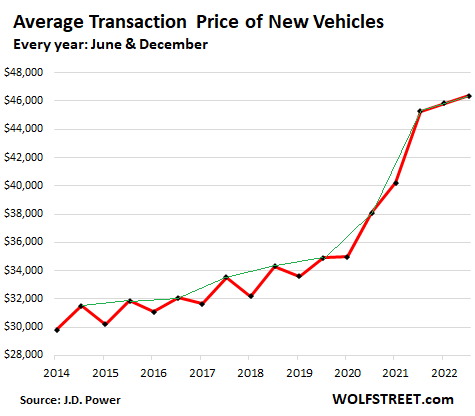

Increasing their models and increasing prices has inflated the average transaction price of new vehicles by almost 50% since 2014, to $46,000 now (JD Power), which is insane:

What has gone horribly wrong with the car industry is that everyone, even Kia and Hyundai, increased the range because that’s where the big profit margins are, and they also increased the prices. And they did it in unison. And over the years, new vehicles have become a luxury that many Americans can no longer afford.

I have been shouting about this for years, because with this strategy, the car manufacturers are losing customers in the US. And as sales stagnated and then fell, they’ve gone up even more to make up in dollars what they were losing in unit sales. This is a huge problem for the industry and for Americans who cannot afford these vehicles.

In 2022, total new vehicle deliveries to end users fell 8% from an already terrible 2021 to 13.7 million vehicles, below what deliveries had been in 1977. Over the past 25 years, the sound barrier for the car industry has been delivery. 17.5 million vehicles a year, and they came close a few times, but never cracked it. As a result of customer price flight, new vehicle unit sales have stagnated for decades, with steep declines in between:

And what this chart also tells you is that booming EV sales are coming at the expense of ICE vehicle sales. Sales of electric vehicles have been the only segment that has grown by leaps and bounds.

Now they’re all after Tesla, after letting Tesla eat their lunch for years. There are now about 40 EV models on the US market. And after Tesla’s price cuts, big price cuts have hit these models.

Total electric vehicle sales rose 45% in the first quarter compared with a year ago to a record 258,882 electric vehicles, according to Cox Automotive. More than 1 million electric vehicles will be sold in the US this year. In the first quarter, the market share of electric vehicles increased to 7.2% of total sales.

So now Tesla is crumbling the oligopolistic playground of the legacy automakers where everyone agreed to raise and keep raising prices. Tesla entered this playground and is taking names, kicking and slashing prices.

Tesla still has the largest profit margins among major automakers and can afford to cut prices to get volume.

Since last year, it has reduced prices several times across the board. And it is constantly adjusting its prices, without being affected by a franchised dealer system. It just raised the prices of its low-volume high-end toy models for the rich by 2% or 3%, even as it massively reduced the prices of its higher-volume low-end models.

Now, a base Model 3 in the U.S., classified as near-luxury, goes for $39,990 on Tesla’s website, excluding rebates. This is approximately 13% below the average transaction price for all new vehicles.

The vehicle also qualifies for the new $3,750 federal tax credit and some state incentives, such as $2,000 in California. I hate EV incentives, EVs would be fine without them, but this is what we have. So the Model 3 now costs $34,240 in California, 25% cheaper than the average transaction price of all new vehicles in the US.

GM cut the price of its Bolt in the $26,000 range before rebates; 43% cheaper than the average transaction price of all vehicles. Ford slashed prices for its Mustang Mach-E SUV. Other electric vehicle manufacturers have also reduced prices.

But they haven’t been able to increase their production capacity and their supply chains, and they still can’t produce at scale like Tesla can, and so their costs are higher. Ford, which is years behind Tesla in building its supply chain and EV production capacity, has said it will lose a lot of money on its electric vehicles over the next few years until production can reach a sufficient scale.

Tesla has changed this dynamic of the auto industry. The promise of electric vehicles was always that they would eventually be cheaper because they are much simpler to manufacture than ICE vehicles. And at scale, they are now cheaper to produce than ICE vehicles, as evidenced by Tesla’s profit margins and price cuts.

And electric vehicles are so easy to build that a whole new generation of startups has amassed, promising to shake up the oligopolistic playground while creating a nice shake-up between them, and lower prices.

That’s how it’s supposed to be: price competition breaks out and prices are driven down until profit margins disappear and those who can’t become low-cost producers are weeded out. Consumers benefit.

But Tesla doesn’t just compete with electric vehicles. From day one they competed with ICE vehicles. And other electric vehicles compete with ICE vehicles. And legacy automakers will have to deal with this threat, and their strategy of increasing and increasing the prices of their ICE vehicles will fail in the face of growing competition from electric vehicles. In the long term, they need to price their ICE vehicles to be competitive with EVs.

But obviously, for shareholders, this kind of competition is tough. Tesla is still a very expensive stock, even though it’s down a lot. GM, Ford and other automakers will blow a lot of money trying to catch up with Tesla; and its ICE vehicles will face margin pressures and volume declines from this intense new low-cost competition. And US electric vehicle startups, the ones that even survive, will be burning cash for years to come trying to develop models, ramp up production and grow their sales to where they can break even. For shareholders this will be tough. But I love the fact that Tesla has tapped into the legacy automakers and is shaking up their game.

Enjoy reading WOLF STREET and want to support it? you can give I appreciate it immensely. Click on the mug of beer and iced tea to learn how:

Want to be notified by email when WOLF STREET publishes a new article? Register here.

![]()