The automotive industry continues to be a hotbed of innovation, with activity driven by the need to increase the life expectancy of an engine, the high performance standards of any vehicle and the growing importance of technologies such as solutions of lubricant additives without sulphur. In the past three years alone, there have been more than 1.2 million patents filed and granted in the automotive industry, according to GlobalData’s Automotive Innovation: Antiwear Lubricants report.

However, not all innovations are created equal, nor do they follow a constant upward trend. Instead, its evolution takes the form of an S-shaped curve that reflects its typical life cycle from early emergence to accelerating adoption, before stabilizing and reaching the maturity

Identifying where a particular innovation is on this journey, especially those in the emerging and accelerating phases, is essential to understanding its current level of adoption and the likely future trajectory and impact it will have.

More than 290 innovations will shape the automotive industry

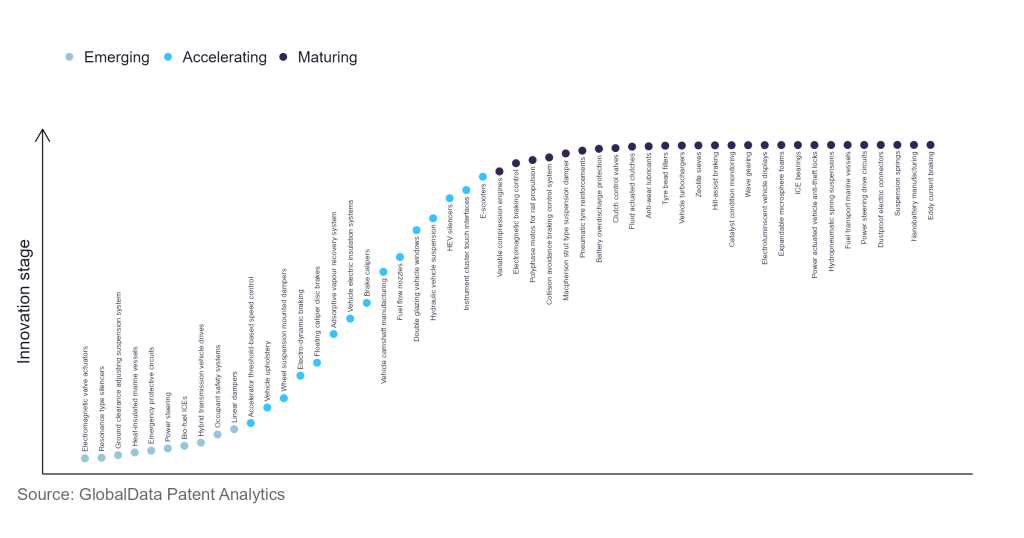

According to GlobalData’s Technology Foresights, which plots the S-curve for the automotive industry using innovation intensity models based on more than 619,000 patents, there are more than 290 areas of innovation that will shape the future of industry

Within emerging The innovation stage, eccentric crankshaft gears, retarder brake system and closed circuit liquid cooling are disruptive technologies that are in the early stages of application and should be followed closely. Biofuel ICEs, Solenoid Valve Actuators and Road Friction Estimation are some of the speeding up areas of innovation, where adoption has been steadily increasing. Between maturing Areas of innovation are tire bead fillers and vehicle turbochargers, which are now well established in the industry.

S-curve of innovation for the automotive industry

Anti-wear lubricants it is a key area of innovation automotive

Anti-wear additives in a lubricating system work to stop abrasion. These additives work by creating a sacrificial coating on a metal surface when the lubricating oil is no longer capable of producing the required film thickness, thereby preventing asperities on the metal surfaces from coming into direct contact.

GlobalData’s analysis also uncovers the companies at the forefront of each area of innovation and assesses the potential scope and impact of their patent activity across different applications and geographies. According to GlobalData, there are more than 30 companies, spanning technology suppliers, established automotive companies and new start-ups engaged in the development and application of anti-wear lubricants.

Key players in anti-wear lubricants: a disruptive innovation in the automotive industry industry

“Application diversity” measures the number of distinct applications identified for each relevant patent and broadly divides firms into “niche” or “diversified” innovators.

“Geographic scope” refers to the number of different countries where each relevant patent is registered and reflects the breadth of intended geographic application, from “global” to “local.”

Patent volumes related to anti-wear lubricants

Source: GlobalData Patent Analytics

Taiho Kogyo is one of the leading patent filers in anti-wear lubricants. The company has used the Lamba Ratio contact to find a method to accurately assess mixed/boundary friction in a lubricated contact when ZDDP anti-wear additives and extreme pressure (EP) additives are used in vehicles. Some other key patent filers in the innovation area include Toyota Motor, JTEKT, NTT, Kyodo Yushi, etc.

To better understand the key topics and technologies disrupting the automotive industry, access GlobalData’s latest automotive thematic research report.