Shares of Tesla ( TSLA ) fell 7% today after earnings that actually met expectations. So what’s the problem? Is Tesla Losing Credibility?

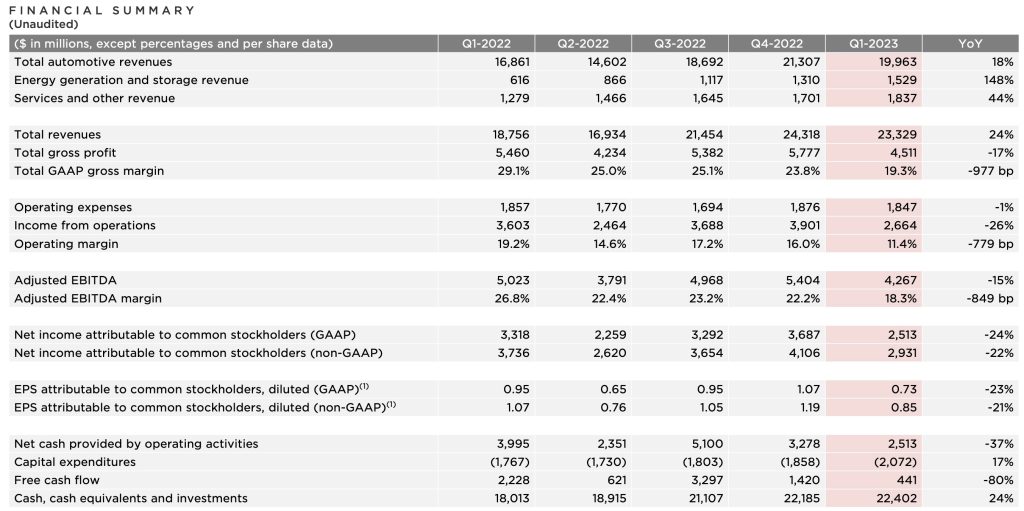

Yesterday, Tesla released its Q1 2023 financial results and beat expectations for earnings of $0.85 per share and even surprised many by maintaining an automotive gross margin above 19% despite significant price cuts during the quarter.

Tesla was still able to deliver an 11% operating margin during the quarter and added hundreds of millions to its cash position.

Tesla’s costs also improved this quarter, with the automaker showing room to absorb new price cuts that were implemented after the end of last quarter.

That’s why it’s surprising to see the stock drop 7% this morning after the market opened. What is happening?

The Electrek dam

Obviously, I don’t know for sure, but I have my suspicions. I think Tesla might be losing some credibility here.

Many Tesla fans were clinging to the idea that Tesla was cutting prices to start a price war and not because it needed to create demand. Those results and the automaker’s comments yesterday confirmed what most people knew to be true: Tesla needed to lower the price to create enough demand to match its output. period

But at the same time, the automaker sought to explain its pricing strategy by saying it is betting on higher profits on the vehicles it sells now with lower gross margins by making them self-driving and by selling future features and software subscriptions .

I think this is where it is losing credibility.

Musk seems to believe that people don’t understand the value Tesla can create by making its electric vehicle autonomous.

The truth is that everyone understands the value, but fewer and fewer people are beginning to believe that Tesla can deliver on its self-driving promises. This is the problem.

Tesla had a significant increase in its stock price because it was selling more electric vehicles than anyone else with a higher gross margin than anyone else.

Now this is still true, but the latter is starting to become less accurate. This is.

It pushes people to have more concerns about Tesla’s demand. However, to be fair, I think most of Tesla’s demand issues leading to these price cuts are mostly not Tesla’s fault. High interest rates and economic uncertainty are undoubtedly the main factors that lead people to put off buying new cars.

So if we see a turnaround in those factors, I think Tesla will see strong demand again and won’t have to cut prices any further, but the problem is that these are factors completely outside of Tesla’s control.

FTC: We use automatic affiliate links to earn income. Month.