Wall Street futures, gold jumped and the dollar fell early Wednesday after the March inflation report showed a softer-than-expected headline CPI but in line with market expectations. But risk assets stumbled after less dovish Fed talks, highlighting at least one more hike in May, and as the FOMC minutes (March) show, the Fed is quite concerned about high core inflation and a potential recession at the end of 2023.

Overall, Wall Street Futures on Thursday saw gold jump on hopes of a Fed pause in May after a softer-than-expected PPI report. On Thursday, Wall Street was somewhat buoyed by the Communications Services, Consumer Discretionary, Technology, Healthcare, Materials, Banks & Financials, Energy, Industrials and Utilities sectors, while he was drawn to real estate.

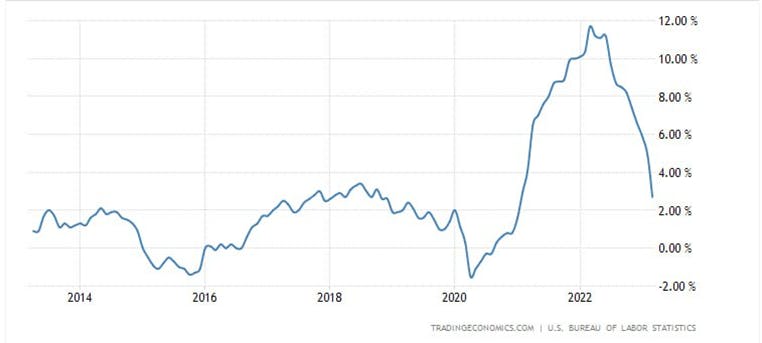

On Thursday, all market focus was on the PPI (Producer Price Index). BLS flash data shows seasonally adjusted annual US PPI inflation (y/y) eased further to +2.7% in March from +4.9% sequential and below market consensus of +3.0%. The manufacturing inflation rate (PPI) was the lowest since January 21, adding to signs that inflationary pressure in the world’s largest economy may be cooling after tightening in Fed policy over the past year. Also, the drop in global oil prices helped.

Sequentially (m/m), US PPI contracted -0.5% in March from unchanged in February, below expectations for a flat reading (0%) and the biggest drop since April 20 (Covid lockdown days). The fall in the general PPI on March 23 was led by a 1% drop in the prices of final demand goods (fuel/energy), specifically gasoline (-11.7%). Indices for diesel, residential natural gas, jet fuel, electric power and fresh and dried vegetables also fell. Meanwhile, prices for services fell 0.3%, also the biggest drop since April 2020, mainly due to a 7.3% drop in margins in wholesale machinery and vehicles Indexes for trucking, portfolio management, retail fuel and lubricants, (partial) loan services, and retail sales of automobiles and auto parts also fell. Looking at the 3M moving average, the average title’s PPI is now around +2.1%.

US core PPI inflation fell further to +3.4% in March from +4.8% in February, the lowest since March 21 and just in line with expectations.

On a sequential basis (m/m), US core PPI declined -0.1% in March from +0.2% in February, below market expectations of +0.3%, and it was the first contraction since April’s COVID-20 days.

Looking at the 3M moving average, core PPI inflation may be around +2.7% compared to pre-Covid levels of around +1.1% (y/y).

On Thursday, there was also some focus on US jobless claims (seasonally adjusted), which serves as an indicator of unemployment trends/general labor market conditions. US DOL flash data shows the number of Americans filing initial claims for unemployment benefits (insured UI) rose to 239,000 in the week ending April 8 from 228,000 the previous week, above market expectations of 232,000 and the first increase in 3 weeks

The 4-week moving average of initial jobless claims, a better gauge to measure the underlying data as it strips out weekly volatility, rose to 240.00K in the week ended April 8 from 237.75K the previous week.

The continuous claims of unemployment in the US, which measures unemployed people who have been receiving unemployment benefits for a week or more or who applied for unemployment benefits at least two weeks ago (according to the UI), it was reduced to 1810 thousand week ended April 1, from 1823 thousand in the previous week, and below market expectations of 1814K.

Continued unemployment claims of all types are also an indicator of the total number of people receiving payments from state unemployment programs; that is, global trend of the unemployed (insured). The latest continuous jobless claims are still high, which may be a sign of some softening in the labor market amid a challenging macroeconomic and geopolitical (foreign trade) environment, along with higher borrowing costs and deluge of technological redundancies.

Overall, based on seasonally unadjusted continuing jobless claims in all categories (UI) of about 1889,000 (2-week average) and assuming the average uninsured employed/self-employed (not receiving any UI benefits) of 4,000,000, the unemployed are estimated to be around 5,889,000 on April 23 vs. 5,839,000 on March 23. Also, if we assume that the labor force is about 167,000K, the unemployment rate would be around 3.5% in April 23 with an estimated number of people in employment at around 161111K, an addition of around +219K sequentially against +577K in March 23 (according to the Household Survey).

Conclusion:

The Fed was already behind the inflation curve since early 2021, when the economy fully opens up after the 2020 COVID disruption. The Fed should have started normalizing its ultra-loose monetary policy in early 2021 instead of starting the process (telegraphing the end of QE and potential rate hikes) in late 2021. In the process, the Fed created synchronized global inflation/stagflation like almost all major G20s. central banks usually follow the Fed’s policy action for the currency (USD) and bond yield spread.

Now (until the banking crisis emerged in the 2nd week of February 23), seeing inflation out of control, both the Fed and the ECB engaged in an ultra-hawkish mandible to tighten monetary/financial conditions, giving leading to a rapid rise in bond and HTM yields. (bond portfolio) loss of mid-sized US regional banks, which are not as efficient at handling rising interest rates in an efficient/professional manner.

The Fed itself is now suffering a huge MTM (unrealized) loss as it offers banks trillions of dollars at higher reverse repo rates; Big US banks are the main beneficiaries of the Fed’s higher reverse repo rates (risk-free yield). But small/mid-sized US regional banks like SVB have a significant asset-liability mismatch, resulting in the current failure.

The Fed will now hold off after one or two more hikes as it believes banks, especially smaller ones, will tighten lending rules, which will eventually tighten financial conditions and consumer demand further, helping to reduce inflation. Over the last year, the Fed was too busy with market control and may not have focused adequately on banking supervision/regulation; especially for vulnerable small/mid-sized US regional banks. Here too the Fed was way behind the curve, almost inviting another 2008-style GFC.

But as immediate concerns about financial stability ease, the Fed may opt for planned rate hikes in a way that is calibrated to ensure price and financial stability, as well as credibility. The Fed may opt for a calibrated rate hike of +25 bps on May 3, and it may also be June 14 for a terminal rate of 5.25-5.50% and then pause. The Fed will ensure financial stability with liquidity tools and price stability with interest rate tools as, unlike in 2008-10, core inflation is still substantially above the +2% targets.

According to the Taylor rule, for the US: (the Fed’s favorite)

Recommended policy type (I) = A+B+(C+D)*(EB) =0.00+2.00+ (0+0)*(5.5-2.00) =0+2+3 .5=5.5%

Here for the US/Fed

A = desired real interest rate = 0.00; B= inflation target =2.00; C= permissible factor of the deviation from the inflation target=0; D = allowable factor of deviation from the potential output target = 0.00; E= average underlying inflation=5.5% (average of underlying PCE and CPI)

Somehow, May’s +25bp hike is now almost certain for the Fed, while there is a question mark for June. But there will be no rate cuts until at least mid-2024, contrary to market expectations. After mid-2024, the Fed may start talking about rate cuts (just before the US presidential election on November 24) to boost Wall Street (risk trading) and also to ensure lower bond yields to bail out the US regional banks and himself. The Fed must also ensure lower borrowing costs for the US government as well as businesses and households.

At the current rate of execution, US core CPI may take another 6 months; i.e. September 23 will fall around +5.0% and September-December 24 will continue to fall around +4.0%, still substantially higher than the Fed’s +2.0% targets. So the Fed needs to keep the real interest rate tight/positive enough for a longer period so that core inflation falls towards the +2% targets on December 25th. If we take the BLS data at face value, the current Fed interest/repo rate at +5.00% equals headline CPI at +5.00%; although it may be pure coincidence, the Fed may hold the repo rate at 5.25 or 5.50% in May or June for a positive real interest rate in the US.