The US shale patch could lose up to 20% of its activity over the next year if energy prices remain at current levels, according to one of the industry’s leading private equity players.

Crude would need to rise about 15% to $80 a barrel, and gas would need to rise more than a third to $3 per million British thermal units for drilling and frack jobs to maintain its current pace, said Wil, CEO of Quantum Energy Partners. VanLoh said in an interview Tuesday. Oil and natural gas prices have fallen since mid-2022 on fears of a global economic slowdown.

“There’s a risk of a pretty big swing this year at these current prices,” said VanLoh, whose Houston-based firm has managed more than $20 billion since its inception in 1998. While the publicly traded explorers and tight drillers would drop rigs and frack rigs, private companies would cut more because their balance sheets aren’t as strong, VanLoh said.

The number of rigs drilling for oil and gas has fallen 3% since the beginning of the year, according to Baker Hughes Co., as the biggest shale explorers meet commitments to maintain production growth and return the benefits to shareholders.

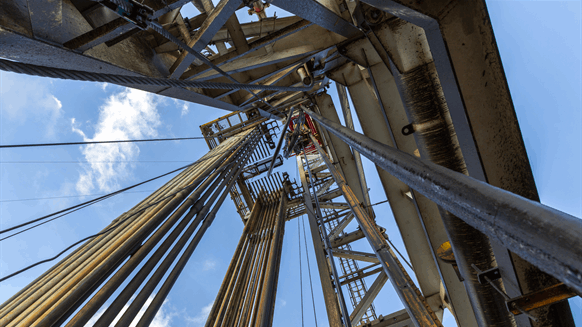

Photo Credit – iStock.com/Fatih Ispir