The collapse of Silicon Valley Bank and the banking crisis it triggered may tighten auto financing and keep new cars out of reach for a growing number of Americans.

New-car prices have fallen to record lows as some dealer incentives have returned, but the average monthly payment for a new car remains above $700 and the average car price is more than $48,000.

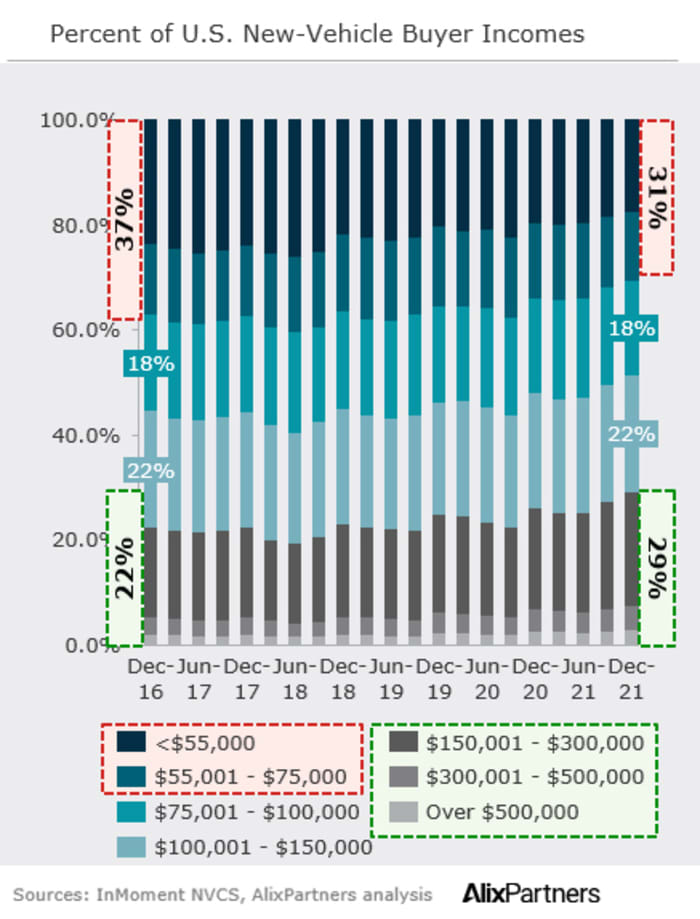

Also, people with higher incomes now make up a larger share of new car buyers.

See also: Sticker shock: ‘MSRP plus’ may be the new normal for car buyers, study finds

Affordability is one of the issues for American automakers such as Tesla Inc. TSLA,

Ford Motor Co. F,

and General Motors Co. GM,

will struggle in the short term, said Arun Kumar, director of consultancy AlixPartners.

“If accessibility becomes a challenge, it will have an impact on your bottom line,” he said.

Cars have become more expensive as they have been loaded with safety features, infotainment and advanced driver assistance systems.

“We’re going to hit a wall at some point, and that’s going to be a pretty rude awakening,” said Karl Brauer, an analyst at iSeeCars.com.

Hot demand favors dealers, he said.

“It’s ridiculous what people are paying for cars now. I don’t know what percentage of the US population can continue to pay these prices.”

The answer has been increasingly wealthy buyers.

Courtesy of AlixPartners

In the five years to December, the share of new car buyers earning more than $150,000 a year rose to 29 percent from 22 percent, AlixPartners analysis showed.

The percentage of new car buyers making less than $55,000 and less than $75,000 a year fell to 31% from 37% in December 2016.

American buyers have gravitated toward more expensive SUVs and pickup trucks for years, prompting automakers to scale back or stop production of cheaper sedans.

Related: Ford files for patent to remotely recover a car, locking owners out of their cars and cutting the AC

Only a couple of compact cars sell for less than $15,000, and a robust self-financing market has made many American buyers tempted to overextend themselves to get more expensive cars, with term loans recently for over the most common five years.

And forget about cheap, simple cars like those sold in emerging markets like China. There is no way automakers can make a “reasonable profit” on cheaper cars, said AlixPartners’ Kumar.

Also, consumers want bigger cars. “The affordability issue is not going to be solved by OEMs building cheaper vehicles,” he said.

Car financing after the collapse of SVB

Auto financing is “available” after the collapses of Silicon Valley Bank and Signature Bank, but lending standards could tighten, putting pressure on OEMs, Barclays analysts said in a recent note.

Financing is a key part of the car market, with approximately eight out of 10 new cars and four out of 10 used cars being financed.

Do not miss: Startups and VCs need another Silicon Valley bank. Can any other bank fill the void?

Regional banks like the ones that got into trouble aren’t big providers of auto loans, but credit unions are, and the banking crisis has shined a light on those lenders, too.

About 30 percent of auto loans are made through credit unions, Barclays said, up from 20 percent three years ago.

Market share gains have come largely at the expense of banks and carmakers’ finance units as credit union lending rates are lower: late last year , according to Barclays, credit union lending rates were around 5.5% while banks were around 5.5%. 7%

Average new vehicle transaction prices in February declined from January, Kelley Blue Book said recently. Sales of luxury brands “continued their strong showing, accounting for 19.5% of total sales, underpinning” overall industry prices.

Prices fell to an average of $48,763, down $705 from $49,468 in January. Transaction prices, however, rose 5.3 percent, or $2,466, from a year ago, Kelley Blue Book said.

New vehicle prices have been above the manufacturer’s suggested retail price, also known as the “sticker price,” for more than a year.

That “MSRP plus,” as some dealers have taken to calling prices above sticker price, has been reduced as higher loan rates and concerns about the economy pressure demand.

Meanwhile, the estimated typical monthly payment for a new car declined 1.9 percent to $765 in February from $781 in January, Cox Automotive said. The average monthly payment peaked at $789 in December.