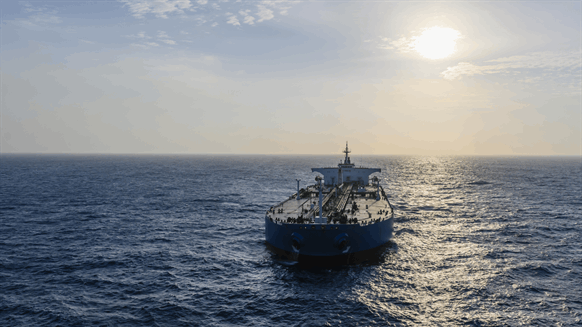

Millions of barrels of Russian diesel are being temporarily stored on tankers as the country deals with the fallout from European Union sanctions.

According to Kpler Pte, ships have been idling off the coasts of Europe, Africa and Latin America in what is by far the largest build-up of floating storage of Russian diesel fuel since the start of gathering data in 2016. Ltd. While the product will almost certainly be unloaded over time, the build-up points to difficulties in replacing EU buyers of Russian fuel.

“They’ve continued to export it even knowing they don’t have a home for it,” according to Mark Williams, director of short-term oil research at Wood Mackenzie Ltd. If Russia’s floating storage and unallocated barrel volumes continue to build, there will be “a sharp reduction in diesel exports.”

The EU’s ban on almost all seaborne imports of diesel – and other petroleum products – from Russia has cut the nation off from its main export market. If it doesn’t find new buyers, exports could shrink, eroding the global supply of a fuel used in everything from trucks to farm equipment.

Locations for the diesel that has been held in floating storage include off the coasts of Morocco and Greece, both known for ship-to-ship transfers of oil cargo, which can make it difficult to track the final destination.

Meanwhile, another cargo, The Loop, is off Brazil, while the Meronas floats near the coast of Turkey.

“It’s not impossible to put a cargo of Russian diesel on the market,” said Viktor Katona, an oil analyst at Kpler. “It’s really a matter of time and, above all, of the buyer’s receptivity to risk, i.e. whether it’s okay to be seen buying Russian diesel.”

The amount of Russian diesel-type fuel held in floating storage cannot continue to increase forever. If it cannot find a home, at some point the country’s exports will have to be cut. Ultimately, it could even affect the nation’s ability to process crude oil.

Wood Mackenzie expects the country’s diesel-type fuel exports to average 750,000 barrels a day in the second quarter, down from 1.1 million in January.

A broader concern for the oil market is whether a drop in Russia’s exports of diesel-type fuel ultimately feeds back into the country’s crude processing operations. With diesel storage options limited, a significant drop in exports would soon force Russian refineries to cut output.

Wood Mackenzie sees a drop of more than a million barrels a day in the country’s crude processing since the start of the second quarter from January.