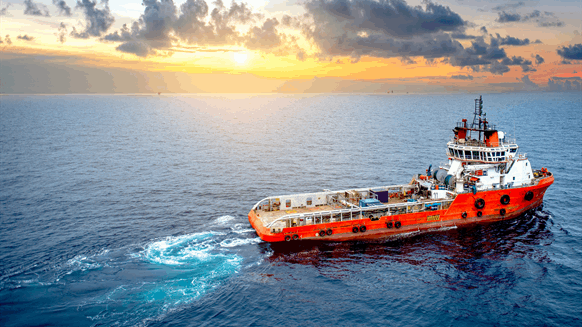

Tidewater Inc. (NYSE: TDW ), based in Houston, disclosed on Tuesday that it has entered into an agreement to buy 37 platform supply vessels (PSVs) from Solstad Offshore ASA for $577 million.

The deal consolidates Tidewater as the leading high-specification PSV operator, enhances the company’s position as a leading global OSV operator with a world-class fleet and creates the world’s largest hybrid fleet, Tidewater said in a company statement published on its website. It also serves as a platform for cash flow generation, Tidewater noted.

Tidewater said it intends to finance the transaction through a combination of new debt and cash. The deal, which the company noted is subject to customary regulatory approvals, was unanimously approved by Tidewater’s board of directors and is expected to close in the second quarter of this year, Tidewater disclosed.

In a statement posted on its site, Solstad said the “strategic move” reduces the company’s debt by approximately NOK 6 billion ($571.8 million), adding that it will “significantly strengthen” the balance sheet, the debt servicing capacity and Solstad’s liquidity position.

Solstad also noted that the deal repositions the company “as one of the leading global owners and operators of high-end AHTS vessels and submarines that are essential to the energy transition” and “allows Solstad to increase its presence in the renewable energy segment”. “.

In the statement, Solstad said its fleet will continue to support customers operating in the offshore energy sector. Both offshore renewables and oil and gas are expected to see significant investment in the coming years, the company said.

“This agreement to acquire 37 PSVs from Solstad Offshore marks another important milestone in strengthening Tidewater’s leadership position as we continue to capitalize on the rapidly improving OSV market,” said Quintin Kneen, President and CEO of Tidewater , in a statement from the company. .

“This acquisition further cements Tidewater as the leader in large, high specification PSVs and as the new world leader in hybrid PSVs. These vessels make up the highest specification fleet of PSVs of their size worldwide. The 37 vessels are currently active and working around the world, mainly in the North Sea, but also in Brazil, Australia and West Africa,” Kneen added.

“Assuming the transaction closes by the end of the second quarter, we upgrade our 2023 revenue guidance to approximately $1.03 billion and our 2023 vessel operating margin guidance remains the same at approximately 50.0 percent,” Kneen continued.

“This transaction is just the latest in a series of transformative steps Tidewater has taken to drive long-term earnings and cash flow generation. We are focused on bringing together the world’s best OSV fleets to create the OSV fleet safest, most sustainable, most reliable and cost-effective high-spec in the world,” said Tidewater’s president.

Lars Peder Solstad, CEO of Solstad Offshore, said that “the sale of the PSVs represents a change in our strategy in a changing market”.

“PSVs primarily support the oil and gas industry, while AHTS and CSVs can serve all offshore energy sectors, including oil and gas and renewables. So this move is in line with our strategy to be a key player in the energy transition. In addition, the transaction will give Solstad greater financial leeway and a significant improvement in debt and cash position going forward,” he added.

“After the transaction, the core competence of the future Solstad will be even better applied to further develop the CSV and AHTS segments, including building our services division and capitalizing on a stronger position in the renewable energy market . The generally higher margins of AHTS and CSV will allow us to improve our finances, strengthen our renewable energy presence and put us in a position to renew our fleet over time,” Solstad continued.

To contact the author, please send an email andreas.exarcheas@rigzone.com