LAHORE: Hi-Tech Lubricants on Tuesday released its half-year earnings on the Pakistan Stock Exchange (PSX), showing the company’s standalone earnings at Rs 106.5 crore and Rs 5.7 crore for Q2FY23 and HFY23, respectively.

However, the company’s consolidated earnings stand at losses of Rs 89 crore and Rs 369.3 crore for Q2FY23 and HFY23, respectively.

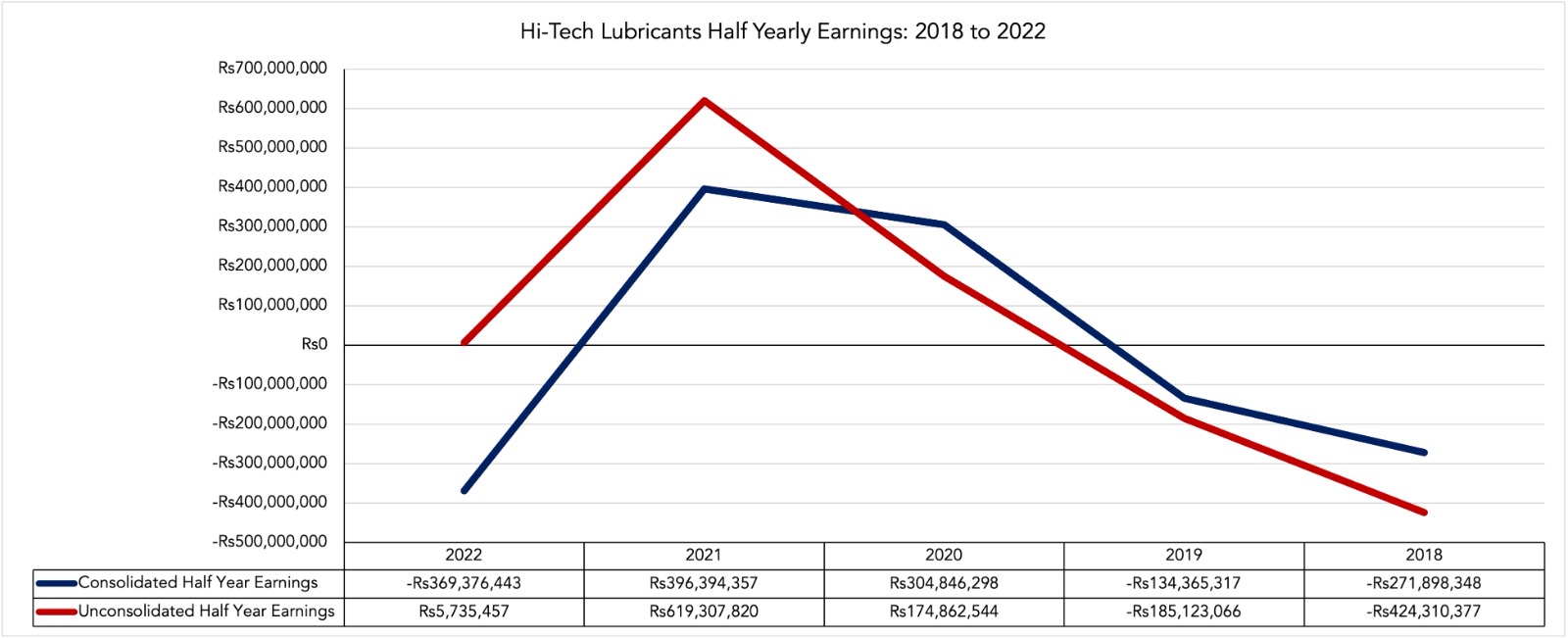

The HFY23 loss of Rs 369.3 crore is Hi-Tech Lubricants’ highest consolidated loss in the last five years, and the HFY23 unconsolidated profit of Rs 5.7 crore is the third lowest ever had the company during the same period of time.

Company profile

Hi-Tech Lubricants Limited (HTL) has been operating in the Pakistani lubricants market for the past 25 years, with the company serving customers in the automotive, industrial and marine sectors. The company launched a one-stop vehicle maintenance solution under the HTL Express Centers brand in 2017 and launched HTL fuel stations across Punjab in 2020.

The company also operates Hi-Tech Blending (Private) Limited, which is a wholly owned subsidiary.

2FY23 unconsolidated earnings

Hi-Tech Lubricants reported sales revenue of Rs 3,847 crore in Q2FY23. This is a quarter-on-quarter (QoT) increase of 11.08% from Rs 4,326 crore in Q1FY23 quarter of 2023, but down 23.3% year-on-year (y-o-y) from the 5.06 billion rupees it reached in 2Q22. The company managed to reduce the cost of goods sold by 11.86% quarter-on-quarter and 2.47% year-on-year. This, however, was not enough as the company’s gross profit declined by 25.14% quarter-on-quarter and 64.72% year-on-year to Rs 259.8 crore. The company’s gross profit margin (GPM) subsequently declined to 6.75% from 8.02% in 1Q2023 and 14.68% in 2Q22.

The company’s other income increased by 997.06% to Rs 303.669 crore. This was also a year-on-year increase of 1966.92%. Other revenue outperformed hi-tech lubricants to post an operating profit of Rs 213.6 crore compared to the loss of Rs 34 crore it posted in the previous quarter. The cost of financing the company, however, increased to 132 million. This was a 45.74% quarter-on-quarter increase and a 20.7.2% year-on-year increase over its previous interest expense. The company posted a negative effective tax rate of 32.13% due to the bonus of Rs 25.9 crore it received. This is a 3.69% quarter-on-quarter increase over its previous discount of Rs 24.9 crore and a 132.09% year-on-year reduction in its tax expense of Rs 80.7 crore in the second quarter of the year 22.

Finally, Hi-Tech Lubricants closed the quarter with a final profit of Rs 106.5 crore. This is a 205.69% improvement over its previous loss of Rs 100.797 crore, but a 61/57% year-on-year reduction from the Rs 277 crore it earned in 2Q12.

Unconsolidated HFY23 earnings

Hi-Tech Lubricants’ total revenue fell 5.95% year-on-year to Rs 8.17 billion, but its net income rose 4.31% year-on-year to Rs 7.3 billion. The company also saw its cost of goods sold rise 17.12% year-on-year to Rs 6.76 billion, with a gross profit of Rs 606.8 crore. This is a 53% year-on-year contraction from HFY22 gross profit of Rs 1,290 crore. The company’s GPM was also reduced from 14.85% to 7.42%.

The company’s other income rose 14.89% year-on-year to Rs 331 crore, while its interest expense rose 223.28% year-on-year to Rs 224 crore. The company’s tax expense also fell by 142.95% year-on-year due to the Rs 50.8 crore tax credit it received. The company closed HFY23 with a total revenue of Rs 5.7 crore. This contrasts with the Rs 619 crore it earned in HFY22.

2FY23 consolidated earnings

The company’s revenue was down 15.23% quarter-on-quarter and 28.35% year-on-year to Rs 3.99 billion. Its net income also declined by 13.03% quarter-on-quarter and 13.97% year-on-year to Rs 3.42 billion. The company, however, reported a gross profit of Rs 419 crore, up 19.18% year-on-year, but a massive 50.06% year-on-year decline. Its GPM subsequently improved from 7.47% in Q1FY23 to 10.5%, but lagged behind Q2FY22’s 15.06%.

Other income rose 27.16% quarter-on-quarter and 104.29% year-on-year to Rs 35.19 crore. Interest expenses also similarly increased by 22.25% quarter-on-quarter and 198.52% year-on-year to Rs 178.9 crore. The company continued to benefit from a tax credit, similar to the previous quarter. The discount at Rs 47.5 crore, however, was 37.74% lower in the quarter. This reduced the company’s tax expense by 167.05% year-on-year from its previous Rs 70.9 crore. The company closed the quarter with a loss of Rs 89 crore. This is a 68.23% quarter-on-quarter improvement over its previous loss of Rs 280.3 crore and a 130.5% year-on-year deterioration from its Rs 290 crore profit last year.

Consolidated earnings HFY23

Overall revenue fell 7.46% year-on-year to Rs 8.7 billion, while net income rose 4.31% year-on-year to Rs 7.37 billion. Cost of goods sold rose 19% year-on-year to 6.59 billion rupees, even as lower revenues culminated in a gross profit of 770.9 million rupees. Gross profit was down 49.28% year-on-year, while GPM also deteriorated from 16.16% to 8.86%.

Other income rose 80.17% year-on-year to Rs 62.87 crore, and interest expenses similarly rose a staggering 236.15% year-on-year to Rs 325 crore. The company’s effective tax rate stood at 25.13% despite a tax allowance of Rs 123.9 crore as it incurred a pre-tax loss of Rs 493 crore. This compares with its previous effective tax rate of 23.01% and pre-tax profit of Rs 514.86 crore. Tax expenditure was reduced by 204.63% year-on-year.

Finally, the company ended its HFY23 earnings with a loss of Rs 369.376 crore. This is a 193.18% YoY decline from the Rs 396.39 crore profit it posted in HFY22.