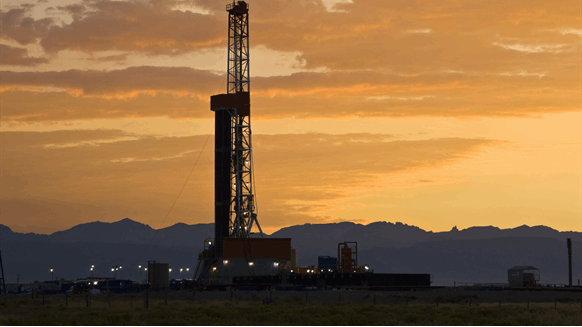

Ineos Energy has announced its first entry into U.S. oil and gas production with the acquisition of a portion of Chesapeake Energy’s oil and gas assets in the Eagle Ford shale for $1.4 billion.

The deal, which Ineos described as “major”, sees the company acquire 2,300 wells producing 36,000 net barrels of oil equivalent per day, Ineos said. The acquisition includes production and exploration leases of 172,000 net hectares and is expected to close in the second quarter of this year, with an effective date of October 2022, Ineos revealed.

In a statement posted on its website, Ineos said the addition of Chesapeake’s assets and operations in South Texas is part of its strategy to build an integrated global portfolio, fit for the energy transition, offering energy solutions from high quality to its customers.

“The deal marks our entry into the North American market and is another important step in Ineos Energy’s journey,” Brian Gilvary, president of Ineos Energy, said in a company statement.

“For the past two decades, U.S. onshore oil and gas production has provided security of supply to the global marketplace and competitive advantage for U.S. industry. We believe this acquisition will help us serve our internal and external customers today as we continue to position our business to address the energy transition,” he added in the statement.

Chesapeake Energy confirmed the deal in a statement posted on its website, noting that it will receive $1.175 billion upon closing, subject to customary adjustments, with an additional $225 million paid in annual installments of $56.25 million. The company said it expects the proceeds will be used to repay borrowings under its revolving credit facility and be available for its share repurchase program.

“Today [Tuesday] marks another important step on our way out of the Eagle Ford as we focus our capital on the premium rock, returns and track of our Marcellus and Haynesville positions,” said the president and CEO of Chesapeake, Nick Dell’Osso, in a company statement.

“We are pleased to have secured a total of $2.825 million to date and remain actively engaged with other parties regarding the remainder of our Eagle Ford position,” he added in the statement.

WildFire Energy Agreement

On January 18, Chesapeake announced that it had entered into an agreement to sell the Brazos Valley region of its Eagle Ford asset to WildFire Energy I LLC for $1.425 billion.

Under the deal, Chesapeake agreed to sell approximately 377,000 net acres and approximately 1,350 wells in the Brazos Valley region of its Eagle Ford asset, along with related property, plant and equipment, Chesapeake said at the time. Average daily net production from these properties was approximately 27,700 barrels of oil equivalent during the third quarter of 2022, according to the company, which noted that as of Dec. 31, 2021, net proved reserves associated with properties were approximately 96.8 million barrels of oil equivalent.

Chesapeake expects the deal to close in the first quarter of 2023. In a company statement at the time, Chesapeake said it expects the proceeds to be used to repay borrowings under its revolving credit facility and be available for its share buyback program.

On its site, Chesapeake describes the Eagle Ford Shale as an important geological formation “as it has the ability to produce both natural gas and oil.” The shale play extends nearly 50 miles wide and 400 miles long with an average thickness of 250 feet and depths ranging from 4,000 to 14,000 feet, Chesapeake notes on its site. The company drilled its first well in the Eagle Ford in late 2009, the site shows.

To contact the author, please send an email andreas.exarcheas@rigzone.com