Originally published on 2/16/2023 at 8:30am ET

A combination of economic data, earnings reports, guidance and general stock market sentiment is driving all stocks right now. This includes penny and higher priced stocks. While broader trends tend to be less impactful for cheap stocks, they’re good to keep in mind because they can greatly influence different sector trends, which can have a greater influence on things like penny stocks.

This month we got our first taste of inflation data from the January CPI report. The inflation data was the first to come out under the new weighting system and was the first report of the year to show numbers above expectations. While markets were initially trading lower, the negative sentiment dissipated by Wednesday’s closing bell, where stocks were trading near weekly highs.

Investors are now focusing on the next round of economic reports, including the first PPI inflation report of the year. This will be accompanied by more labor and employment data that could influence the outlook and influence how traders approach the markets.

Although at the January/February FOMC meeting, the Fed explained its stance on rate hikes and not raising as aggressively this year as it did in 2022, some think this may change based on the data. It has already shown that the labor market remains tight and that inflation is still higher than Wall Street expects. Whether or not this changes the FOMC’s stance on monetary policy in 2023 remains to be seen.

What we do know is that in the stock market today, all eyes will be on the January PPI inflation report. Let’s go over some of the basics for those who may not be familiar with and are asking questions like:

- What is PPI in economics?

- PPI inflation data vs. CPI Inflation Data and Why PPI Data Matters for the Stock Market Today

- How can PPI inflation data be used in your investment and trading strategy?; and finally

- What are the results of the January PPI inflation report?

What are the results of the September PPI inflation report?

What is PPI inflation data and what is the PPI report?

The PPI is “a measure of the average change over time in the sales prices received by domestic producers for their output is what has defined the producer price index,” according to the Bureau of Labor Statistics of USA “The prices included in the PPI are from the first commercial transaction for many products and some services.”

PPI vs. CPI: Why is PPI important?

Product price index inflation data is important because it is a data point for investors to understand future inflation trends. It can also be used as a means of enacting monetary policy.

CPI Data VS PPI Data

Compared to CPI data, the producer prices in the PPI report show a picture through the lens of companies that produce final goods, what their input costs are and give insight into whether prices can whether or not to cause a jump or a fall in retail costs incurred by consumers. .

PPI expectations January 2023

Let’s look at PPI expectations for January 2023. Year-over-year PPI estimates for January are set at 5.4%. This would be lower than the 6.2% PPI reading in the last product price inflation report. The month-on-month figures are likely to be the most telling sign for the market. Estimates place it at 0.4% for January. Note that almost immediately after the report, FOMC member Mester will speak, which could also influence stock market sentiment today.

The January 2023 producer price index report and PPI numbers

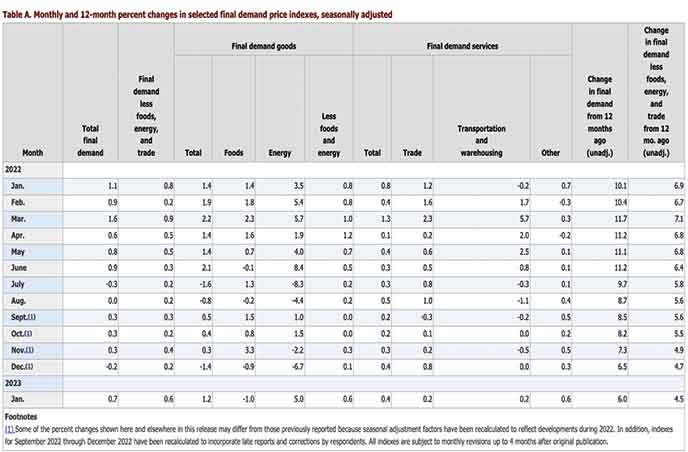

The producer price index for final demand rose 0.7 percent in January, seasonally adjusted,

the US Bureau of Labor Statistics reported today. Final demand prices fell 0.2 percent

December 2022 and advanced 0.3 percent in November. (See Table A.) On an unadjusted basis,

the final demand index rose 6.0 percent in the 12 months ending January 2023.

In January, a 1.2% rise in prices of final demand goods led the advance in the final

demand index. Prices for final demand services also rose, increasing by 0.4 percent.

The final demand index minus food, energy and commercial services rose 0.6 percent in January

2023, the biggest advance since it rose 0.9 percent in March 2022. Over the past 12 months

in January 2023, final demand prices minus food, energy and commercial services rose by 4.5

per cent.

Final demand

Final Demand Goods: The final demand goods index rose 1.2 percent in January

the biggest increase since rising 2.1 percent in June 2022. Most of January’s advance was due to a

5.0% increase in final demand energy prices. The index of final demand for goods less food i

energy rose 0.6 percent. In contrast, final demand food prices fell by 1.0 percent.

Product Detail: Almost a third of January’s rise in the final demand goods index can be traced to

to gasoline prices, which increased by 6.2 percent. The indices of residential natural gas, diesel

Fuel, jet fuel, soft drinks and motor vehicles also rose. Conversely, the prices of fresh and dry

vegetables decreased by 33.5 percent. The indices of residual fuels and basic organic chemicals

also declined. (See Table 2.)

Final demand services: The final demand services index advanced 0.4 percent in January

the same as in December. More than 80 percent of the overall increase in January is attributable to prices

for final demand services less trade, transport and storage, which increased by 0.6 percent.

Margins in final demand business services rose 0.2 percent. (Trade indices measure changes in

margins received by wholesalers and retailers.) Final demand transportation prices i

storage services also advanced 0.2 percent.

Product detail: The index was a major factor in the increase in prices for final demand services in January

for hospital outpatient care, which increased 1.4 percent. The indices of automobiles and automobiles

retail sale of parts; retail sale of health, beauty and optical products; portfolio management; chemicals and

wholesale of related products; and airline passenger services also increased. Instead, the margins

retail sales of fuels and lubricants fell 17.5 percent. Long distance motor transport prices and for

securities brokerage, trading and investment advice also declined.

PPI Report Breakdown: Key Findings

PPI inflation data for January came in 6% above expectations

Month-on-month PPI inflation data came in at 0.7%, above expectations

The core PPI was 4.5% year-on-year and 0.6% monthly

Processed goods for intermediate demand: The index of processed goods for intermediate demand rose 1.0 percent in January, the first advance since a 1.9 percent increase in June 2022 .Topping January’s increase, prices of processed energy goods rose 5.4 percent. The index of processed food and feed advanced 0.3 percent.

More than half of the increase in processed product prices for January intermediate demand can be attributed to the diesel index, which rose 10.9 percent. Electric power, utility natural gas, gasoline, beef and non-ferrous mill forms also advanced.

More than 60 percent of the January decline in unprocessed goods prices for intermediate demand can be attributed to the natural gas index, which fell 19.1 percent. Prices for ungraded chicken eggs, crude oil, broiler chickens, hogs for slaughter and recyclable paper also declined.

Leading the advance, prices for services minus trade, transport and storage for intermediate demand rose 0.8 percent. The transportation and storage services index for intermediate demand rose 0.4 percent.

More than three-quarters of the January advance in the intermediate demand services index can be attributed to a 6.6% increase in (partial) loan service prices. Indexes for services related to (partial) securities brokerage and trading, wholesale of chemicals and related products, legal services, portfolio management and US postal services also rose. In contrast, margins in the retail sale of fuels and lubricants fell by 17.5%.