When Russia announced last week that it would cut oil production by half a million barrels a day in retaliation against Western sanctions, there was skepticism about whether it was actually doing so by choice.

Russia is entangled in an ever-tightening web of economic restrictions, from bans on technology exports to the country to a recent European Union ban on most of its oil imports. As far as the West is concerned, Moscow is crumbling under the weight of sanctions.

“It wasn’t voluntary, it was forced on them,” Kadri Simson, the EU’s energy commissioner, said in an interview in Cairo. “They don’t have the ability to sustain production volumes because they don’t have access to the necessary technology.”

However, data from Russia tell a different story.

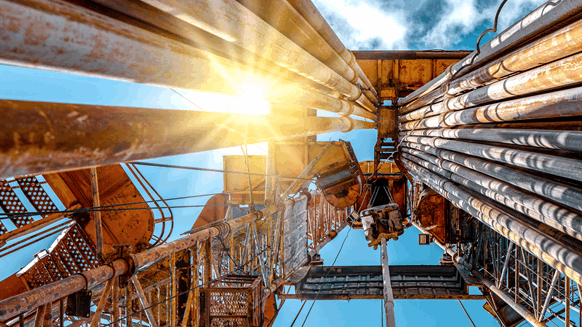

Russian companies did the most drilling in its oil fields in more than a decade last year, with little sign that international sanctions or the exit of some major Western companies would directly hurt so-called upstream operations. This helps explain how the country’s oil production rebounded in the second half of 2022, even as more restrictions were placed on its exports.

“The industry continues to function largely as before,” said Vitaly Mikhalchuk, head of the research center at Business Solutions and Technologies, formerly the Russian unit of consulting firm Deloitte & Touche LLP. “Russia has been able to retain most of the oil service competencies, assets and technologies.”

Since President Vladimir Putin’s decision to invade Ukraine nearly a year ago, Russia’s oil industry has seen the most dramatic change in political circumstances since the collapse of the Soviet Union.

Major Western companies including BP Plc, Shell Plc and Exxon Mobil Corp. walked away from multibillion-dollar investments in the country. Some of the leading international service providers followed suit. Europe also introduced “a comprehensive restriction on exports of equipment, technology and services for the energy industry to Russia.”

However, Russian oil rigs drilled a total depth of more than 28,000 kilometers last year, the most in more than a decade, according to industry data seen by Bloomberg. The total number of wells started rose nearly 7 percent to above 7,800, with most major oil companies beating results from a year earlier, the data showed.

Several factors have helped Russia keep its oil industry going.

First, major international suppliers accounted for only 15% of the country’s total oil services segment in 2021, according to data from Vygon Consulting. Domestic units of domestic producers such as Rosneft PJSC, Surgutneftegas PJSC and Gazprom Group make up most of the market, the data showed. Those companies did not respond to requests for comment.

“Russian companies attract foreign contractors if they need high-tech services and equipment,” as well as advanced software, according to a report by the Moscow-based consultant. But these things are not generally necessary to keep oil flowing from established fields.

Second, some of the largest Western oil service providers did not leave the country. SLB and Weatherford International Plc continue Russian operations, with some limitations.

SLB CEO Olivier Le Peuch said in July that his company’s unique corporate structure gives it flexibility to work in Russia while fully complying with US and EU sanctions. The company did not respond to a Bloomberg request for comment.