The CME/NYMEX Henry Hub futures price has fallen precipitously in recent months and 2023 has the potential to be one of the most bearish in recent history. But in the longer term, the stage is set for tighter balances, price spikes and greater volatility. After a slowdown in 2022-23, LNG export capacity additions will be fast and furious over the next few years. As they do, they will outpace production growth, which will increasingly depend on pipeline and other midstream expansions. In other words, 2023 will be the last replica of the Shale Age surpluses. We’ve had a taste of what 2022 could look like, but how far could the gas market go? In today’s RBN blog, we discuss the supply and demand trends that will shape the gas market over the next five years.

In Part 1, we summarized the various factors that drove gas prices from 14-year highs near $10/MMBtu six months ago to the sub-$3/MMBtu prices seen in recent weeks. It started with the closure of the Freeport LNG export facility after a fire last June that took almost 2 Bcf/d of demand out of the market instantly. On top of that, a soft fall shoulder season further dampened demand production hit single-day highs of another 100 Bcf/do. And the final death knell for the near-term bullish outlook? One of the most bearish starts to the new year in at least 13 years, possibly ever. An unusually warm January crushed demand, with domestic consumption falling to six-year lows in January and lagging by more than 14 Bcf/d year-on-year, while the Freeport outage kept exports flat. At the same time, the warmer weather remained wellhead freezes Strip and dry gas production topped the 100 Bcf/d monthly average for the first time in January, averaging 6.2 Bcf/d higher than last year. As a result, the balance of supply and demand was the loosest we’ve seen in January since at least 2010, and about 20 Bcf/d looser than last year.

These trends exacerbated what was already a bearish scenario for 2023. This is because, for the first time since 2016, there is little upside to LNG export growth expected this year. Freeport is in the process of restarting operations, but this is the return of existing capacity. And while Venture Global’s Calcasieu Pass will be commercialized this year, it was already taking feed gas for much of last year at a rate consistent with full utilization. Beyond that, there is no new online export capability this year. On the other hand, Lower 48 dry gas production is on track for a nice year-over-year gain. To the extent that storage has to absorb the rest, we are likely to see surpluses increase, which will not only mean lower prices from 2022, but a return to the kind of limited price action we saw before covid

But as we also mentioned in Part 1, the 2023 downturn is likely to be short-lived as the next wave of LNG export capacity begins ramping up in 2024 and will accelerate over the next few years ( more about the latest project deadlines in a future blog). Overall, production is likely to keep pace, but as the market tightens, the potential for a misaligned schedule between LNG exports and production growth will make for an easy ride in some years . This brings us to our five-year outlook and how the balances are likely to adjust for the year.

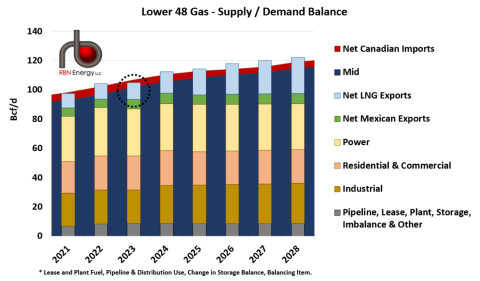

Figure 1 below summarizes the components of the Lower 48 gas supply-demand balance equation in our medium scenario through 2028, assuming the current futures curve. The stacked layers at the bottom represent annual averages of supply components, including dry production (marine) and Canada’s net imports (red). (LNG imports, once a major source of supply, are now minimal or nonexistent, depending on the time of year.) The columns in the foreground stack the various sources of gas demand, such as now lease, plant and pipeline fuel. (gray), residential and commercial (peach), industrial (brown), gas-fired power generation (yellow), exports to Mexico (green), and LNG exports (the blue bars at the top of the stack).

Figure 1. Average scenario of the balance between supply and demand for natural gas 48 of RBN. Source: RBN

We’ll start with our full-year forecasts for 2023. After accounting for actuals to date, RBN has internal demand (including power, industrial, res/comm and lease, plant, pipeline losses and storage combined), with an average of 87 Bcf/d. , down nearly 1 Bcf/d from 2022, assuming normal weather. (Last year was marked by colder-than-normal winters and a warmer-than-normal injection season, which contributed to record consumption). Exports to Mexico are forecast to average 6.3 Bcf/d, up from 5.7 Bcf/d last year, while LNG feed gas deliveries (segments of blue bar) will be 11.7 Bcf/d, up ~1 Bcf/d from the previous year. -course That brings total demand, including exports, to about 105 Bcf/d, a net increase of 0.8 Bcf/d year-over-year. However, at this level, demand would fall short of supply (dashed black circle).

On the supply side, dry gas production in our forecasts averages 102 Bcf/d in 2023, up about 5 Bcf/d a year earlier. This assumes that Appalachian production will be constrained by pipeline capacity, but that the other basins will grow unconstrained as average capacity is built in time to support growth. Canada’s net imports responded to the tight Lower 48 gas market last year, but we expect it to moderate to 4.8 Bcf/d this year, down from 5.5 Bcf/d in 2022. That leaves the Lower 48 balance at 1.7 Bcf/d. supply in 2023 (106.8 Bcf/d of total supply minus 105.1 Bcf/d of total demand).

However, it will be a completely different story in the coming years as the next wave of LNG projects come online, but production is increasingly dependent on the next pipeline project that comes up (see the Where is it block series). Surpluses will shift to a deficit as LNG export capacity additions begin to outpace production gains. Based on what RBN identifies as Tier 1 or better LNG projects in ours LNG Voyager After slowing in 2022-23, LNG capacity additions will accelerate, generating an increase of ~3 Bcf/d in feed gas demand each year on average between 2024 and 2026, and another 1.8-1.9 Bcf/d in 2027 and 2028. This is a 14 Bcf/d increase in demand from LNG exports alone compared to 2022 levels (and does not include additions of capacity in Canada or Mexico). Combined with domestic demand, this means that total demand in our medium scenario grows ~18 Bcf/d (an average of 3 Bcf/d per year) from the 2022 level to 122.2 Bcf/d in 2028.

By comparison, our intermediate scenario for total supply, including imports, is projected to grow by a much more modest 16.6 Bcf/d over the same period to 119 Bcf/d in 2028. Breaking it down further moreover, we expect production to grow. by 17.9 Bcf/d to a total of 114.8 Bcf/d for then. After this year, we expect moderate growth and an average of 2.5 Bcf/d per year through 2028. Canada’s net imports are also expected to decline somewhat in the coming years as exports of LNG is emerging as a major source of demand in Western Canada and competes with pipeline exports for production and pipeline capacity. What this means for our middle case supply and demand scenario is that the lower balance 48 becomes the supply.long in 2023 to be ~2 Bcf/d short in 2024, and worse, to a negative 4.3 Bcf/d in 2027.

In other words, the Lower 48 gas market is headed for a period of gas scarcity, driven by export growth and slow production growth dependent on midstream development. Of course, there are risks to this perspective. A massive storage surplus this year could spill over into next year and delay the onset of a gas shortfall. A delay in LNG export capacity additions, or extended outages like the Freeport outage, would have a similar effect. On the other hand, the average constraints that hold back output growth could cause it earlier. And time will remain the constant wild card. But the bottom line is that with the onslaught of LNG exports, the odds of oversupplied conditions extending beyond 2023 in the Lower 48 gas market have diminished considerably.

“The Final Countdown” was written by European singer Joey Tempest. It appears as the first track on the side of Europe’s self-titled third studio album The final countdown. Released as a single in February 1986, the song peaked at number 8 on the Billboard Hot 100 Singles chart. Songwriter Tempest said the lyrics were inspired by David Bowie’s “Space Oddity.” The song’s polyphonic synth riff is reminiscent of Bill Conti’s intro. Rocky theme song, “Gonna Fly Now.” Both songs are popular at sporting events. “The Final Countdown” synth riff was played on a Roland JX-8P synthesizer by Mic Michaeli. The album personnel were: Joey Tempest (lead vocals), John Norum (guitars, backing vocals), John Leven (bass), Mic Michaeli (keyboards, backing vocals) and Ian Haugland (drums, backing vocals).

the album, The final countdown, was produced by Kevin Elson and recorded between September 1985 and March 1986 at Powerplay Studios in Zurich, Soundtrade Studios in Stockholm, Master Sound Studios in Atlanta, GA and Fantasy Studios in Berkeley, CA. Released in May 1986, the album charted at #8 on Billboard’s Top 200 Albums chart and has been certified 3x platinum by the Recording Industry Association of America. Five singles were released from the LP.

Europe is a Swedish rock band formed in Upplands Väsby, Sweden in 1979 by vocalist Joey Tempest, guitarist John Norum, bassist Peter Olsson and drummer Tony Reno. They made their big professional breakthrough in Sweden in 1982 by winning the TV talent show, Rock-SM. They rose to international fame in 1986 with their hit album, The final countdown. The group has sold more than 10 million records worldwide. The band went on hiatus in 1992, with members Tempest, Norum and Kee Marcell releasing solo albums before regrouping and continuing in 2003. They have released 11 studio albums, eight live albums, five compilation albums , an EP and 35 singles. They were inducted into the Swedish Music Hall of Fame in 2018. Nine members have passed through the group since its formation. Europe still records records and tours.