Kevin Brine

Competitors are gaining ground

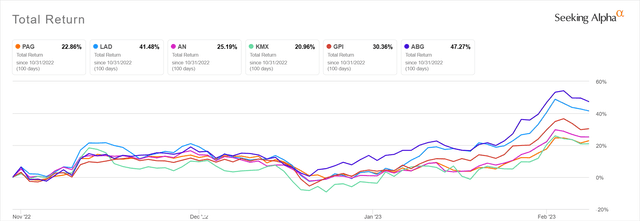

Since I wrote about Penske Automotive Group (NYSE: PAGE) in October, shares have returned nearly 23%. Maybe Hold’s rating was too harsh, but most of its competitors have done even better.

Looking for alpha

Despite lagging stock performance, Penske remains one of the most valued on a P/E basis, although it looks cheap compared to the overall market.

Looking for Alpha

As I’ve mentioned in previous articles, Penske is different from its peers because of its luxury brand focus, truck sales and leasing business, and overseas exposure, especially in the UK. This diversification can be useful as it gives the company more ways to earn, but it can be a drag when some segments underperform. Used car business and UK dealer exposure is costing Penske right now while other parts of the business are well Let’s take a look at how Penske’s quirks are helping or hurting right now.

Advantages and disadvantages

Luxury brand focus

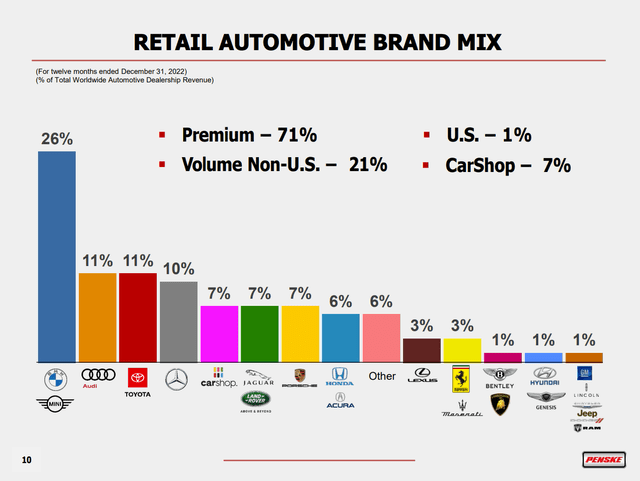

Penske’s auto dealers are heavily focused on premium brands, with 71% of sales concentrated in this area, including 26% with BMW.

Penske Automotive Group

This combination of brands is a huge advantage for Penske right now. When the supply chain is tight for automakers, they tend to direct the parts they have toward their most profitable models. Also, when the economy slows, the premium car customer is the last to be affected. CEO Roger Penske pointed this out on the earnings call.

… I think the premium customer right now, affordability obviously hasn’t affected them, even with higher interest rates. But what’s driving our margins and our success, again, is certainly supply. And when you think about what we’re accomplishing, they’re building the best cars they have at the highest margins not only for the factory, the OEM, but for us as well. And I think growth continues to be strong…

Sale of trucks

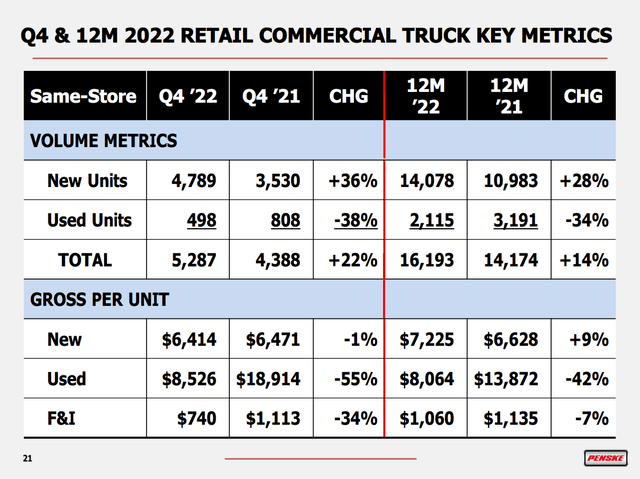

The truck sales business remains strong. On a same-store basis, Penske increased unit sales by 36% in Q4 compared to the same quarter last year. This represents accelerated sales growth when you look at the full year growth rate of 28%.

Penske Automotive Group

Looking at growth overall, rather than the store itself, is even more impressive. Penske added 4 truck dealerships in 2022. With truck sales from the newly added dealerships, unit sales were 5,181 in 4Q (42.8% growth) and 17,932 in fiscal 2022 (37.9 % growth). Penske currently prefers trucks to car dealerships as an acquisition target because of their cheaper valuations and lower upgrade costs once purchased. Roger Penske had these comments on the earnings call:

When we look at the truck side, the multiples have been less than the car side, point number one. Point number two, the CapEx requirements, meaning tiles, furniture, et cetera, we don’t have that on the side of the truck. So, for me, the CapEx requirements are significantly lower when you’re talking about buying typically a US dealership.

Sales look strong going forward. Penske also noted that 75% of those sales were Class 8 commercial trucks. Industry-wide, the North American sales forecast for 2023 is 294,000 and the backlog today stands at 244,000 units , which represent 10 months of sales. The manufacturer’s allotment of Penske Class 8 trucks for the year is now sold out.

Truck rental

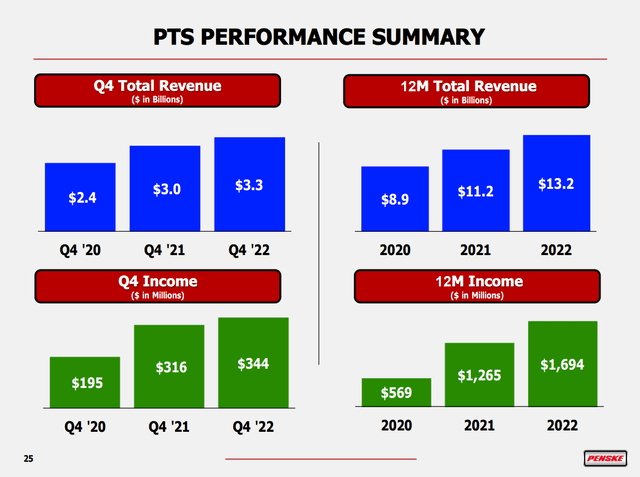

The truck leasing business, Penske Transportation Solutions, is 28% owned by PAG and accounted for as an equity investment. The company currently has a fleet of 414,000 trucks and plans to expand to 500,000 by 2025. This business has grown steadily and accounts for more than 1/4 of PAG’s pre-tax revenue.

Penske Automotive Group

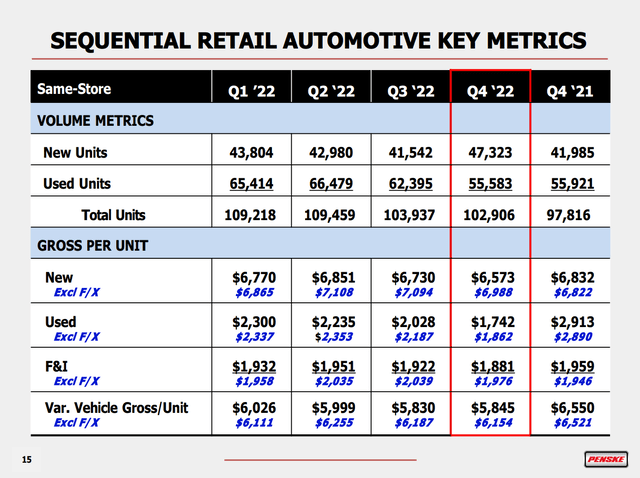

Sale of used cars

The used car business is currently a major headwind for Penske. Finally, the new car supply chain is normalizing, resulting in more unit sales and more cars on the lot (25 sales days vs. 21 at the end of 2021). Used car sales are still at their lowest number in the past 5 quarters and used car gross margins are down 40%, much worse than new car margins.

Penske Automotive Group

Historically, Penske has relied on the return of leased vehicles as a key source of used car supply. The lower volume of new car sales in 2021 and early 2022 has created a lag effect, restricting the supply of used cars. Customers also prefer to buy rather than rent. As Roger Penske noted on the call,

I think the lease penetration is down significantly because of certainly when we look at the residual support and also some of the support that we get from the finance companies. And when you look at it in real numbers, 55% of our premium was leased before maybe the last 12 to 18 months. And our overall, from Penske’s perspective, was 34%. We are down to 11%.

Used car inventories were 53 days of sales at the end of 2022, even tighter than 60 days at the end of 2021. Used car sales may be more attractive going forward, but the supply picture will need to improve.

UK Dealers

The obvious disadvantage of foreign dealers in a strong dollar environment is the negative impact of currency exchange. As stated in the earnings release,

Currency translation negatively impacted revenue by $1 billion, income from continuing operations before taxes by $38.0 million, income from continuing operations attributable to common stockholders by $29.4 million and earnings per share by $0.40.

This represents an approximately 3.5% impact on revenue and a 2% impact on pretax income and EPS.

The supply of used cars has also been particularly difficult in the UK. CarShop stores in the US were able to source 73% of their inventory by 2022, but in the UK this figure was just 37%.

As the Fed nears the end of its tightening cycle in the US, the dollar may finally begin to weaken. Additionally, Penske noted an improvement in CarShop sales in January along with availability.

Capital management

Penske doesn’t include a cash flow statement in its earnings release, and the 10-K isn’t out yet. However, considering that the cash balance is essentially unchanged from last year, we can see that the company maintains a very strong balance sheet while offering shareholders the best returns on capital.

In 2022, Penske spent $393 million on acquisitions, including 9 car dealerships, 2 truck dealerships and 2 open spots for future car dealerships. They also spent $283 million in capex. These two uses of cash investment came to almost the same amount as in 2021.

The company paid out $154 million in dividends in 2022. Penske continues to raise the dividend each quarter, most recently a $0.04 increase to $0.61 payable on 3/1/2023. Penske greatly expanded its share buybacks in 2022, spending $887 million and reducing its share count by an impressive 11%.

Penske increased its inventory and accounts receivable by $554 million, but also increased its payables, including plant debt, by $528 million. Going back to the income statement for a minute, I have to note that interest expense on the floor plan is tied to short-term rates and has become much more important this year. In 4Q 2022, it was 6.6% of operating income, up from 0.8% in 4Q 2021.

We see that after all this capex and M&A activity, high return on equity for shareholders, and negligible change in working capital, Penske’s long-term debt only increased by $148 million. With a total of $1.6 billion in debt (not including the plan), the company has a very low leverage of 0.8 x EBITDA.

Looking ahead, I predict that Penske will continue to increase its dividend by at least $0.04 each quarter. I expect similar levels of M&A and capex. Buybacks may be lower than the 2022 high to avoid adding debt at higher interest rates. Still, the CFO often mentions that the company has “the ability” to leverage up to 4x EBITDA if a growth opportunity presents itself, though I personally wouldn’t want that to happen.

conclusion

Shares of Penske Automotive had a strong performance last quarter. It remains at a higher valuation than most of its peers, even though its peers’ stocks had an even stronger quarter. However, Penske’s premium brand focus, its truck business and its international diversification make it a unique company. The UK used car business and dealers are a drag on the company at the moment. This underperformance is being offset by a strong truck business, although some of the negative factors could improve this year anyway.

Penske is an excellent stock here for an income investor, as it appears to have the ability to continue increasing its dividend each quarter. However, after the big rally in the share price, PAG stock might need to take a breather, and I would suggest waiting for lower levels before adding.