Tales of Lithium

Lithium (Li) was first recognized as an element in 1817 when Swedish chemist Johan Arfvedson analyzed the mineral petalite. “The metal itself was first isolated in useful amounts in 1855. In 1869, Dmitri Mendeleev correctly placed it alongside sodium, with the alkali metals, in his then-revolutionary periodic table of the elements,” according to the Service US Geological Survey (USGS).

With a specific gravity of 0.534, it is about half as dense as water and the lightest of all metals. In its pure elemental form it is a soft, silver-white metal, but it is highly reactive and is therefore never found as a metal in nature.

“Lithium has an average concentration of 20 parts per million in the Earth’s continental crust. It is more abundant than some of the more familiar metals, such as tin and silver. Lithium is found in most rocks as a trace element, and lithium replaces magnesium in common rock-forming minerals,” the USGS says.

India’s Reserves: “Inferred Resources (G3)”

Most of us are now familiar with lithium; what about its uses ranging from mobile phones and laptops to electric vehicles? But before we get into where India is, how this lithium from J&K can be used and much more, it is important to understand one thing from GSI’s statement. “Inferred Resources (G3)”.

Inferred Resource means “that portion of a Mineral Resource for which tonnage, grade and mineral content can be estimated with a low level of confidence. It is inferred from geological evidence and assumed geological and/or grade continuity but not verified.

The UN Framework Classification of Fossil Fuels says that, with the exception of past production that can be measured, quantities are always estimated and there will be a degree of uncertainty associated with the estimates.

This uncertainty is communicated by citing discrete amounts of decreasing confidence levels (high, moderate, low).

“A low estimate scenario is directly equivalent to a high confidence estimate (G1), while a best estimate scenario is equivalent to the combination of the high and moderate confidence estimates (G1+G2). A scenario of high estimate is equivalent to the combination of high, moderate and low confidence estimates (G1+G2+G3),” says the UN.

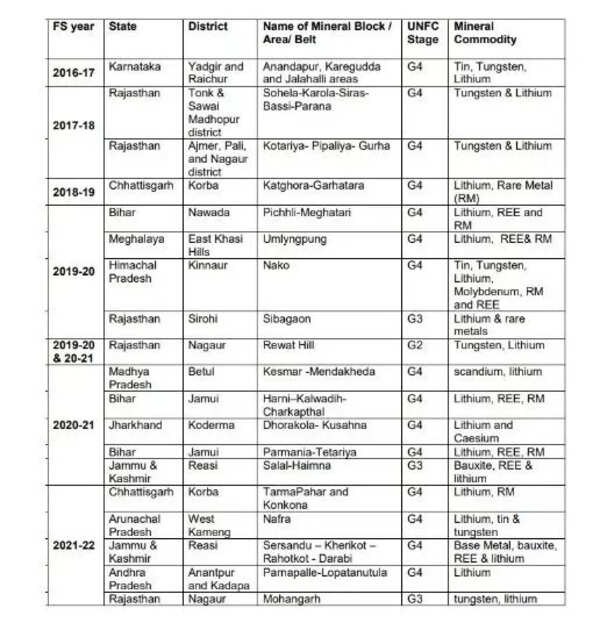

The G4 class, for example, means that the project is still in an exploratory phase. And according to the Union Ministry of Mines and Coals, this is what India has been doing in recent years:

Global reservations

According to the US Geological Survey (USGS) Mineral Commodity Summaries, 2022: Globally identified lithium resources have been revised to 80 million tonnes. However, reserves from which the element can be accessed to date are set at just over 22 million with Chile leading the table (9.2 million tonnes).

While the USGS data breakdown does not include reserves in China, Statista, a global company specializing in market and consumer data, pegs it at 1.5 million tonnes.

It lends itself to many uses

Although lithium has many uses, the most prominent are in batteries for cell phones, laptops, and electric and hybrid vehicles.

Some key uses according to USGS include: lithium added to glasses and ceramics for strength and resistance to temperature change; it is used in heat-resistant greases and lubricants, and is alloyed with aluminum and copper to save weight in the structural components of the airframe.

“Lithium is used in certain psychiatric medications and in dental ceramics. The lighter of two lithium isotopes, 6 Li, was used in the production of tritium for nuclear weapons,” USGS says.

But the use with the greatest potential benefit for most people in the world is in rechargeable batteries. These batteries take advantage of lithium’s light weight and high electrochemical potential and enable cars and trucks to be powered using carbon-neutral, renewable energy sources (eg solar, hydro or wind) instead of petrol or diesel.

Lithium ion batteries and India

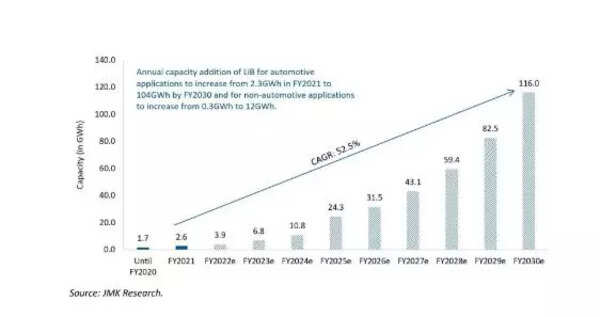

The introduction of lithium-ion batteries (LiB) has revolutionized many sectors, especially the electric vehicle industry. LiB adoption is accelerating in India and JMK Research, a specialist renewable energy consultancy, estimates that the annual LiB market in India will reach 116 GWh by 2030, with EVs accounting for around 90% of the global market. large government targets to add variable renewable energy sources to the grid.

Key players in India

Of the total LiB cost, the cells account for 65%, the battery pack 15%, the BMS (battery management system) 15%, and the balance is the outer case, according to JMK Research.

So far, battery packs and associated BMS manufacturing have completely dominated the space in India and Indian manufacturers are able to produce most of the sub-components that go into a battery pack, while thermal pads are still ‘must matter.

Similarly, BMS and outer case are also mainly supplied by Indian battery assemblers. “However, since India does not have BMS manufacturing components, it sources pre-programmed protection circuit boards (PCBs) from China and engages in printing in India. The LiB package manufacturing market in India is fragmented and includes numerous active players such as Coslight India, Okaya, Exicom followed by Trontek, Amptek, Cygni, Grinntech, Lohum Cleantech, Pure EV etc.

In what was a first for the country, the Vikram Sarabhai Space Center (VSSC) of the Indian Space Research Organization (Isro) successfully developed and qualified lithium-ion cells with capacities ranging from ‘1.5 Ah up to 100 Ah.

This was for use in satellites and launch vehicles and Isro, after the successful deployment of indigenous Li-ion batteries in various missions, was engaged in transferring this technology to industries to set up facilities of production to produce lithium-ion cells to cover the entire spectrum of energy storage. country requirements.

What does the government do?

The Centre, with the aim of ensuring that at least 30% of new vehicle registrations are electric by 2030, has focused on developing the value chain of batteries – cells – and, for this encourages the local manufacture of lithium ion cells.

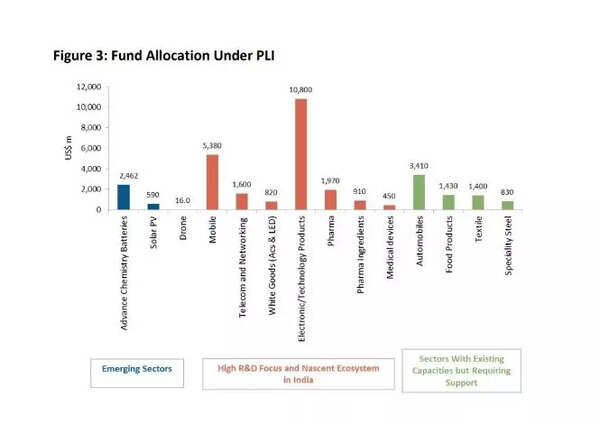

In April 2021, the Center doubled the import duty on lithium-ion cells to 10% and later announced that a PLI scheme includes financial allocations for cell chemistry batteries (ACC) under the National Program for Advanced Chemical Cells (NPACC) and for automobiles and automobiles. components with an emphasis on promoting local manufacturing.

Batteries share the overall PLI scheme according to JMK Research’s analysis of government data: